Since July 1, 2019, Shanghai has enacted its household-garbage sorting management regulation, which stipulates that all garbage must be sorted into four categories: recyclable waste (可回收垃圾), hazardous waste (有害垃圾), household food waste (湿垃圾) and residual waste (干垃圾). Any individual who mixed hazardous waste and household food waste with other garbage could be fine up to 200 yuan. To ensure everyone will follow this new rule, the city government “recommended” residential complexes to implement a “designated time and location for garbage throwing”, which ends up people being allowed to throw away trash ONLY at two two-hour time windows every day (eg. 6:30 – 8:30, 18:00 – 20:00).

These efforts have ushered in new buzzwords on Chinese social media, such as “trash-throwing freedom” (which means 996 workers (9 am till 9 pm, six days a week) don’t have time to throw away their trash during designated time), and a new greeting line for Shanghai people when they meet in front of the trash bins: “what kind of rubbish are you?”

Jokes aside, garbage sorting will not stop at mega cities like Shanghai: China is expanding this practice to all big cities. By the end of 2020, 46 big cities, mostly with populations of more than 2 million people, will have established their “basic garbage sorting systems”. By 2025, all prefecture and above level cities should have done so.

For Chinese consumers, very soon when they make purchasing decisions, they will have to think about the eventual cost of throwing away the garbage. Some more environmentally sophisticated consumers will also consider whether the brand they’re buying from has minimized its impact on environment through its production, operation and distribution.

This trend has turned sustainability into a new growth opportunity for brands in China – it is no long just a corporate social responsibility initiative, it is a concrete business consideration. Kantar’s researches have found that sustainability-aware brands will win more Chinese consumers as this trend gets stronger.

Do Chinese consumers care about sustainability?

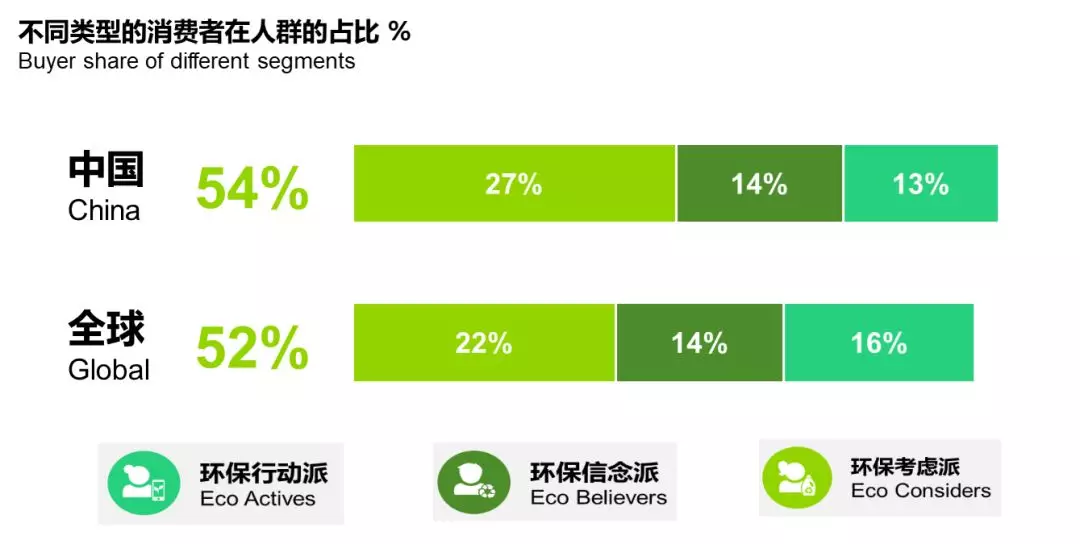

Now 93% of Chinese consumers think FMCG manufacturers did not do enough to reduce plastic waste; 54% of Chinese consumers care about sustainability and have taken actions.

Eco Actives care about sustainability, and have taken multiple actions to reduce waste;

Eco Believers care about sustainability, and have taken one or two actions to reduce waste;

Eco Considers care about sustainability, but have not taken actions.

Kantar Worldpanel data showed that nearly half of Eco Actives live in tier-1 or tier-2 cities, and they are more likely to be high-income family. This means that sustainability-aware consumers have stronger buying power. By better serving this segment, brands can not only contribute to protect the Earth, but also find long-term growth for themselves.

In fact, even without China’s garbage-sorting efforts, Chinese consumers’ attention on environmental protection has been growing organically. Global Monitor, another survey by Kantar, has found that the proportion of Chinese consumers agreeing “I feel that I can make a difference to the world around me through the choices I make and the actions I take” jumped to 63% in 2019 from 51% in 2017. Also, 71% of surveyed consumers are willing to “pay more money for products that are better for the environment”, 16 percentage points higher than global average.

Of all surveyed consumers, 84% said “it's important to me that the brands I buy from are committed to making our society better” – 18 percentage points higher than global average.

Success cases

In China, many brands have launched and implemented their sustainability strategies, and make them known by consumers. Kantar Worldpanel’s research has found that consumers can identify some brands that have taken efforts to reduce waste, such as KFC, McDonald’s and Starbucks. But we have noticed that many frequently mentioned brands are fast-food retailers, instead of FMCG brands. This is partly because fast-food brands have been quite active in protecting environment in the past year.

Act now

“Sustainability” is no longer an optional box to tick: it’s a compulsory question that all brands will be required to answer. This is also not a homework only for brand’s marketing department – it’s for every business unit and for every step in a brand’s operation. Kantar would suggest brands to develop and implement their sustainability strategy from the follow dimensions.

* Consumer understanding

Consumer’s need to buy sustainable brands

Trigger and barrier to recycle/reuse product/package

Motivation to purchase

Loyalty towards sustainable brands

* R&D

Ingredient innovation

Material selection

New technology

* Package innovation

Modulization design

Possibility to be reused/recycled/degraded

Communicate sustainable messages via package

* Communication language

Establish brand mission on sustainability

Encourage consumers to live a green lifestyle

Educate consumers how to use sustainable products/packages

* Supply chain

Upstream – zero waste production

Midstream – high efficiency distribution/logistics

Downstream – recycle waste & educate consumers

* Collaboration

Collaborate with tech companies to develop product, upgrade production line, re-design service

Collaborate with sustainability organization/charity to better communicate brand image

Join third-party sustainability initiative or alliance, even working with competitors, such as the Loop initiative supported by Unilever, P&G, Colgate and many other FMCG brands in the United States.

To know more consumer insights and brand consultancy about sustainability in China and other parts of the world, please contact us.

EDITOR'S NOTES

* To reach the author, or to know more information, data and analysis of brand consultancy in China and other parts of the world, please contact us.