Following four years of significant growth in China, e-commerce continues to steadily gain acceptance among consumers, bringing about some clear and noticeable changes to shopping and consumption habits. However, according to volume two of Kantar Worldpanel and Bain & Company’s 2017 China shopper report – “Keeping up with China’s Shoppers at Two Speeds” - the rising digital activity has had little impact on certain key elements of consumer behaviour, such as brand loyalty.

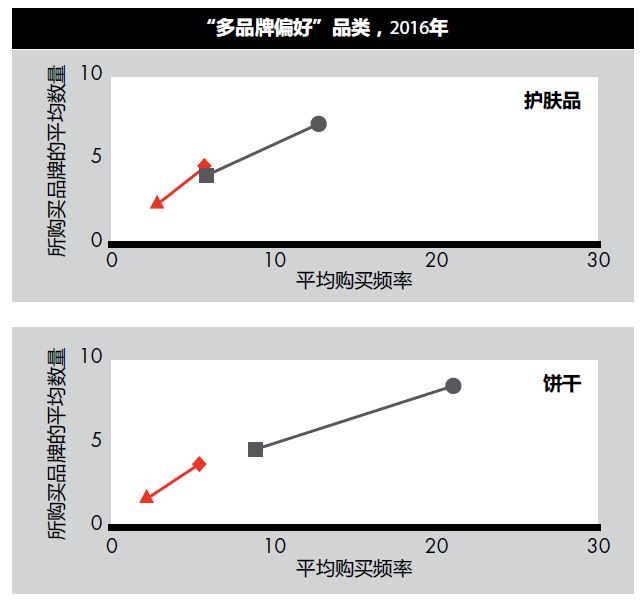

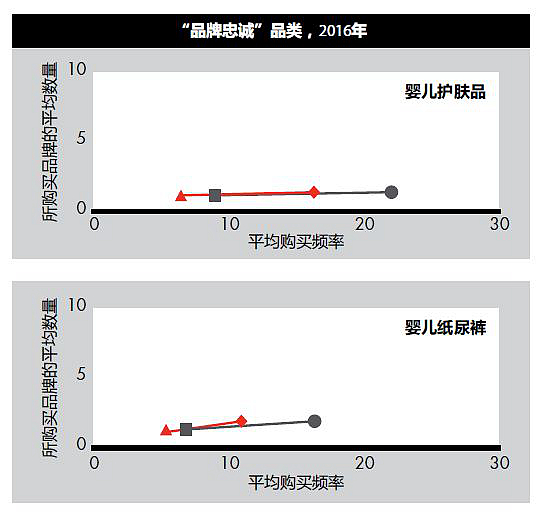

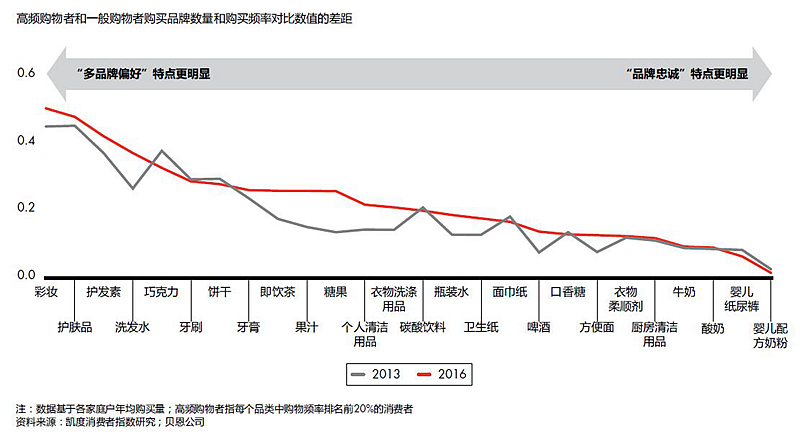

Since 2012, Kantar Worldpanel and Bain & Company identify the fast-moving consumer goods categories as either “repertoire” or “loyalist” category.

* In repertoire categories, the more frequently consumers shop, the more brands they try;

* In loyalist categories, shoppers buy the same brands regardless of increasing frequency.

“Our research shows that repertoire-loyalist categories still break down along the same lines as they did when we first began researching brand loyalty five years ago,” said Bruno Lannes partner in Bain’s Greater China Consumer Products Practice and co-author of the report.

We found that the categories still show the same repertoire or loyalist characteristics as they did in 2013, even with the shift toward e-commerce. Because e-commerce offers a seemingly endless array of products, many expected that it would lead consumers to more repertoire behaviour. But the data shows that’s not the case. What’s more critical is the nature of the category itself.

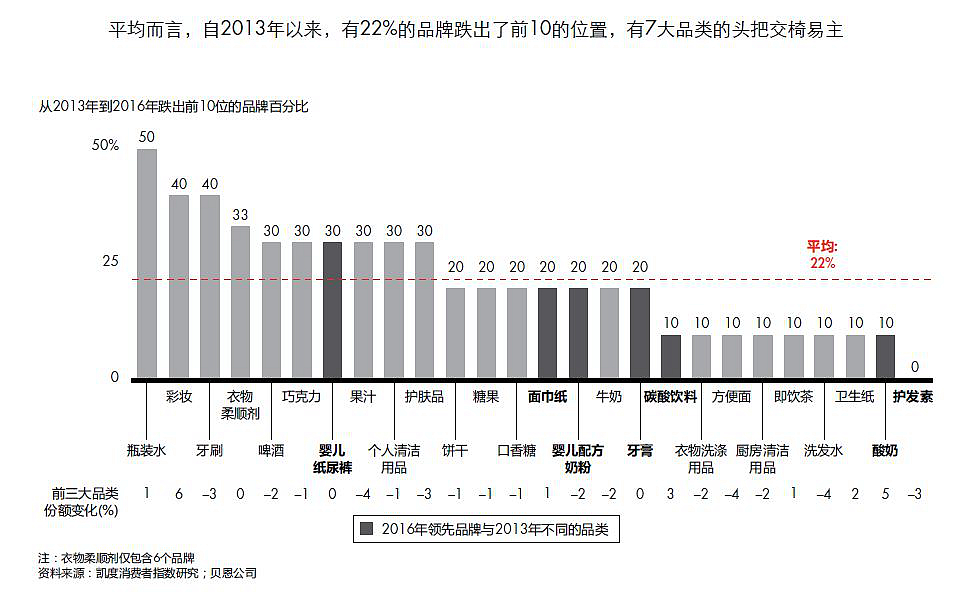

Online commerce hasn’t made the FMCG market more volatile for brands. Similar to what we found in 2013, categories remain very competitive, and market share continues to be up for grabs. Across the 26 categories studied, 22% of the top 10 brands in 2013 had dropped from the list by 2016, and seven categories had a different market leader (see Figure 13). In some categories it’s particularly tough to stay on top. For example, the market leadership position in yogurt has rotated among Mengniu, Yili and Bright. In skin care, eight of the top 10 brands in 2013 had changed their rank three years later.

“What’s changed is that we’re able to say with a good degree of certainty that category’s online penetration has minimal impact on where it lands on the repertoire-loyalist continuum. Similarly, loyalty patterns are not altered by shoppers’ movements between offline and online channels, which means that the imperative for brands to drive penetration to grow continues to be paramount,” Bruno concluded.

A brand’s penetration is defined as the percentage of households in a market buying a particular brand in a given year.

As Chinese shopper behaviour evolves, one critical fact of life holds true: Market leadership is determined by a brand’s ability to boost and maintain household penetration.

As we explained in China Shopper Report 2014, Vol. 2 (Chinese Shoppers: Three Things Leading Consumer Products Companies Get Right), the key to growing market share is to boost penetration. Kantar Worldpanel and Bain & and shopper reports validate this insight. And even in the era of e-commerce, we find that penetration remains more important than other measurements like purchase frequency or repurchase rate.

Why penetration is paramount, and why shoppers need to be constantly recruited and re-recruited? For three main reasons, similar to the findings three years ago:

- Consumers have a very low engagement with brands, as evidenced by the very low purchase frequency of leading brands (in most categories, leading brands are bought less than 3 times/year)

- Yet, even in the age of online shopping – with its ease of repurchasing - penetration continues to be a leaky bucket.

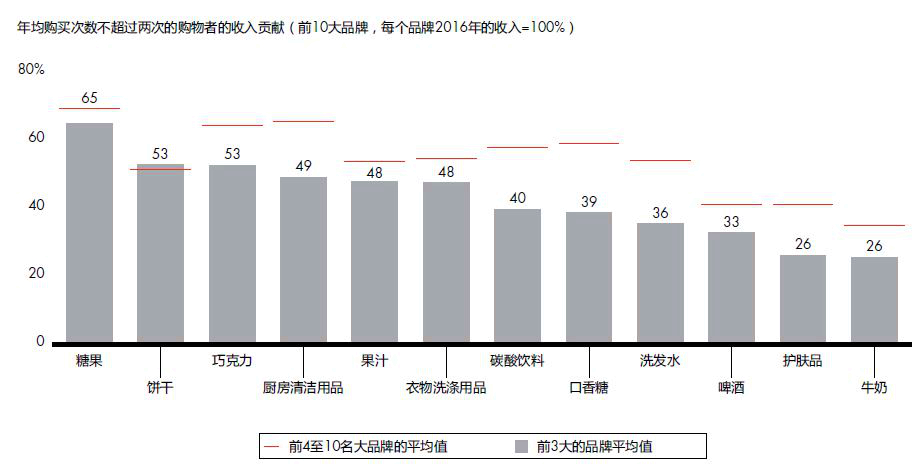

“Most shoppers of a brand will switch to a different brand within two years, creating the need for consumer goods companies to continuously recruit and re-recruit shoppers, rather than to expect them to buy more or make more frequent purchases,” said Jason Yu, general manager of Kantar Worldpanel Greater China. “This means brands need to focus their attention on another critical characteristic of buying behaviour: low frequency shoppers. Those that purchase a brand one or two times a year account for the majority of the shopper base for most brands and actually contribute most of the revenue, according to our analysis.”

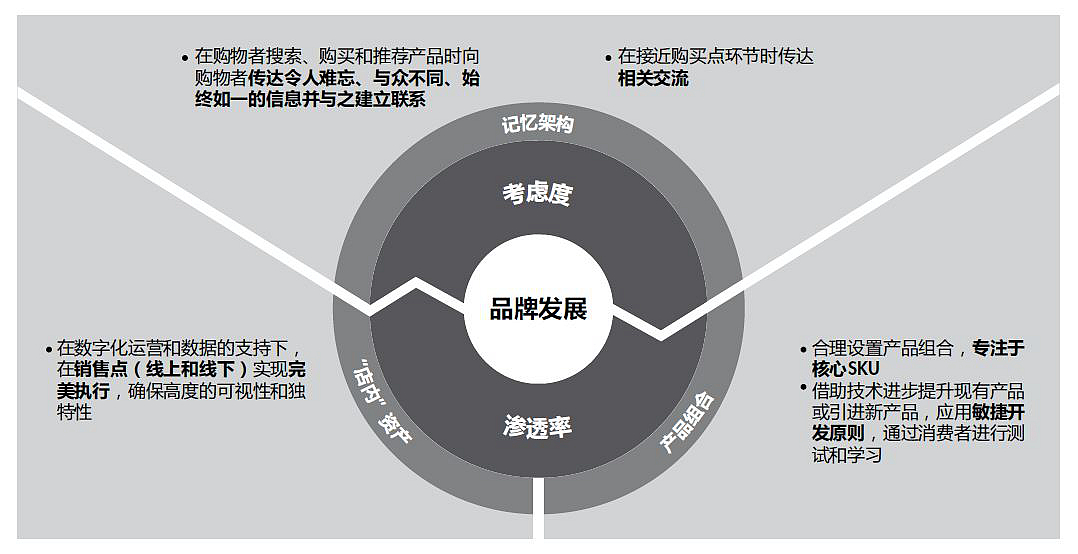

Brands attempting to navigate China’s challenging business environment where shopper behaviour is evolving alongside with e-commerce must earn customer consideration and brand penetration by investing in three key assets – memory structure, product portfolio and in-store execution – and viewing those assets in a new digital context.

• Memory structure. The goal is to build memorable, distinctive, and consistent messages and connections with shoppers as they research, purchase and recommend products. Brands not only need to target wide enough audiences, but also deliver relevant communications closer to the point of purchase.

• Product portfolio. Brands can optimize their product portfolio like never before, use digital advances to improve existing products and introduce new products specific to each channel and platform, using agile development approaches to continuously test and learn, introducing new products that offer consumers what they expect, including more personalized offerings.

• In-store execution. In today’s omni-channel world, brands are required to ensure perfect execution both online and offline, with a coordinated approach supported by the abundance of newly available data.

EDITOR'S NOTES

* Authors of the full report: Marcy Kou, CEO at Kantar Worldpanel Asia; Jason Yu, general manager at Kantar Worldpanel Greater China; Bruno Lannes, a partner with Bain’s Shanghai office; Jason Ding, a partner with Bain’s Beijing office;

* To reach the author, or to know more information, data and analysis of China's FMCG market, please contact us.