As consumers become more aware of how they are being impacted by the COVID-19 pandemic and businesses start to reopen, there has been an increase in smartphone volume sales in EU5, the U.S. and Australia by at least 4.4% compared with the second quarter of 2020, while sales in China and Japan declined, with at least 1 in 5 smartphones purchased being a mid-tier model.

In the third quarter iOS grew by +6 percentage points year-over-year and Android grew in China (+5% pts.) and Japan (+3.7% pts.). In all other reported markets OS shares are stable. However, beneath the surface of stability, while iPhone holds flat, shares among Android brands are shifting. Mid-tier manufacturers Xiaomi and Oppo are gaining in EU5 markets and Japan while Huawei declines YoY. That said, Huawei continues to experience strong growth locally in China by 5.7% pts. Samsung too, has not escaped the growing popularity of Xiaomi and Oppo, gaining share only in Japan (+5.4% pts.). Mid-tier smartphones also continue to attract consumers YoY. In the latest quarter across all reported markets, the iPhone SE, Samsung A series and/or Xiaomi all feature in the top 5.

Online sales shares continue to grow YoY across all markets, except in China where this channel is flat. Although, in recent months online sales shares of smartphones in France, Germany, Italy and China are starting to come back down to pre-COVID levels. Nonetheless, ecommerce is an important channel and is here to stay; in Great Britain, Spain, Japan, Australia and the US, where online shares in the month of September 2020 remains higher than pre-COVID (February 2020). Therefore, a strong online presence and positive customer experiences through this channel is critical now and in the future.

With many announcements and upcoming releases, such as the Samsung S20 FE, Google Pixel 5 and the launch of iPhone 12 flagship range, Q4 2020 is set to be a very exciting quarter.

Apple’s offering of four models in this year’s line-up is a very interesting strategy, particularly in the premium-tier price range (one tier below super-premium) with iPhone 12 mini.

Unlike previous flagships, iPhone 12 mini gives customers all of the latest specifications and 5G capability, but in a smaller form factor at lower cost, in-line with many areas of market growth. While share growth over the last couple of years has been for larger screen sizes, Apple is tackling both ends of the spectrum with this launch, as at least a third of smartphones owned in all markets except China have a screen size less than 5.5” and over 12% buyers chose their model specifically for “how it fits in my hand/pocket”.”

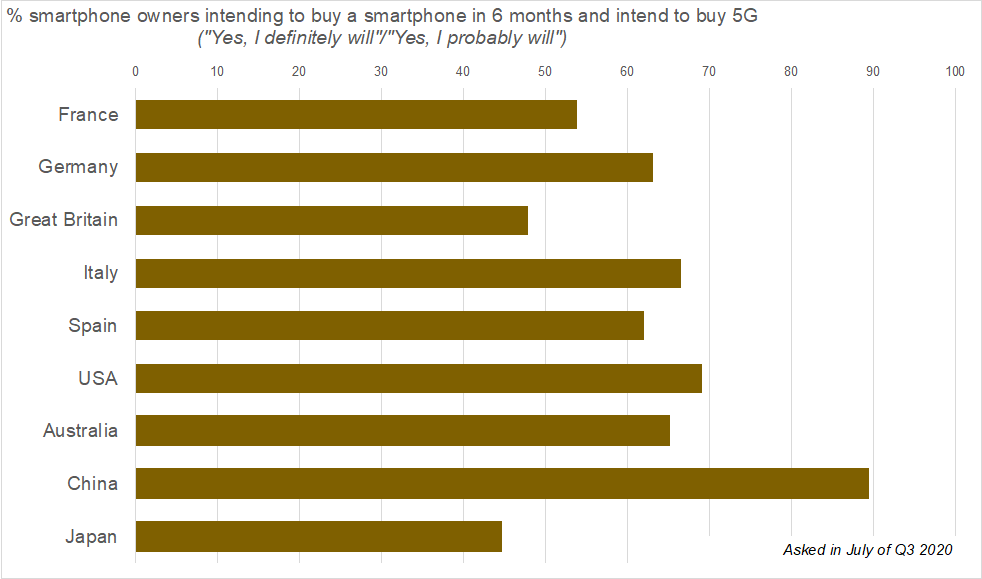

As more 5G-enabled devices launch, “5G capability” as a reason for choosing specific models bought, although still small relative to other drivers, has increased across all reported markets since Q4 2019, particularly in China increasing by 23% pts. Among customers who plan to purchase a smartphone in the next 6 months, at least 45% across all markets intend to buy 5G; the highest being in China at 89% followed by the US at 69%. Commercially, the benefits of 5G is being marketed as delivering high speeds and uninterrupted connectivity to support activities such as gaming, streaming video on demand and video calling.

5G can offer support to improve consumer experiences in the day-to-day activities they use their smartphones for. That said, how consumers value this is an area we will understand better as the market evolves. In the latest quarter, based on how smartphone owners used their devices daily to every few days, we observed increased usage of GPS quarter-over-quarter in EU5, Japan and China as countries slowly started to open up more businesses and relaxed lockdown rules. In the last month, the proportion of consumers using their smartphone for streaming video services increased YoY (except in Spain and Japan), at least 1 in 3 are playing games and 1 in 5 have streamed music from their smartphone.