Take-home grocery sales increased by 5.4% in the four weeks to 1 September 2024, according to our latest data, as Irish households prepared for the new school year. Shopping frequency increased by 0.7% in September, along with an increase in average prices of 2.4%. Volumes per trip were up slightly by 0.4% after six months of decline.

Despite inflation rising again and sitting at 2.8% over the last 12 weeks compared to the same period last year, it is still the lowest inflation level since March 2022 and is down 8.5 percentage points from September 2023.

As summer comes to an end, many shoppers prepared for the back-to-school routine, with more packed lunches and after-school meals to prepare. Shoppers continue to take advantage of promotional offers from retailers with spending on promotions up 9.6% compared to this time last year.

Shoppers are also being drawn to retailers' own label ranges. Sales of own label products performed strongly, up 4.5% year-on-year, holding a value share of 47%, with shoppers spending an additional €66.8 million year-on-year on these ranges. Premium ranges also continued to do well, with shoppers spending an additional €14.2 million on these lines, up 10.2% compared to this time last year. However, with major retailers heavily promoting brands in their recent advertising campaigns, branded goods outpaced total market growth, increasing by 8.4%, with shoppers spending an additional €121 million compared to last year. Over 60% of branded products were purchased on some form of promotion, a 9.8% rise from the same period last year.

Schools’ back for autumn

As summer ends and the back-to-school season approaches in late August and early September, parents begin preparing for the return of school routines, including packed lunches. This led to increased spending, with an additional €2.1m on biscuits, €1.3m on cheese and €460k on bread. As busy schedules take hold, shoppers also turned to quick meal options, resulting in an extra €2.6m spent on chilled convenience foods compared to August.Irish retailer performance update

Online sales were up 10.7% as shoppers spent an extra €18.2 million year-on-year. A boost in the frequency of online trips contributed a combined additional €17.5 million to the overall platform.

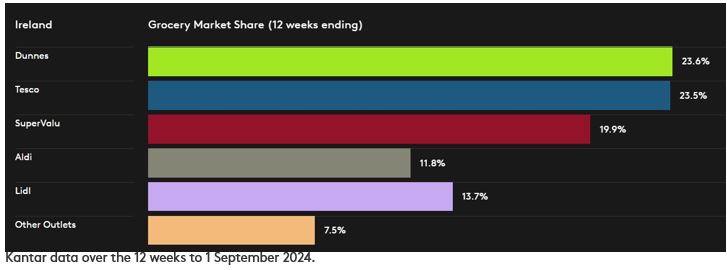

Dunnes hold 23.6% market share with growth of 9.4% year-on-year. It had the strongest growth in trips amongst all retailers, up 12% year-on-year and contributing an additional €83.6 million to their overall performance.

Tesco holds 23.5% of the market, up 10.4% year-on-year. Tesco’s growth stems mainly from more frequent trips, which contributed an additional €32.9 million to their overall performance.

SuperValu holds 19.9% of the market with growth of 2.5%. SuperValu shoppers make the most trips in-store when compared to all retailers, 21.8 trips on average, up 2.5% year-on-year, which contributes an additional €15.5 million to their overall performance year-on-year.

Lidl holds 13.7% share with growth of 6.9% year on year. More frequent trips in-store, alongside new shopper recruits, contributed an additional combined €27 million to their overall performance. Aldi holds 11.8% market share with growth of 1% year on year. More frequent trips contributed an additional €9.4 million to their overall performance.