Advertising in the pharma category is complex, particularly on a global level, due to the swathe of rules that apply which can vary by market. A quick check of the UK government website throws up a long list of dos and don’ts when advertising to the public. Do: name the product, its active ingredient, instructions etc. Don’t: make misleading claims, quote recommendations, suggest there are no side-effects, compare to others etc. The list goes on and of course, don’t direct your advertising at children under 16 and absolutely ‘no free samples.’

The Pharma category is further complicated by its dual marketing aspect, with over-the-counter products (OTC) which can be advertised globally and direct to consumer (DTC) marketing, which is the advertising of prescription products directly to the patient or healthcare professionals (HCP’s). The US and New Zealand are the only markets that allow public showing of DTC ads that include product claims. Within DTC there is a further breakdown of types of ads, each being subject to different regulations. And that’s not all - DTC ads ‘can’ be promoted directly to HCP’s in other markets, but this is exacerbated by over-targeting and has resulted in them feeling inundated, with too much marketing and too little time. Over half (55%) of HCP’s have reported feeling overwhelmed by pharma content according to the Digitally-Savvy HCP report, so additional considerations are needed to avoid irritation and confusion, in terms of both media channel and creative content. So pharmaceutical advertising ain’t easy; it’s complex and dynamic, with lobby groups intermittently attempting to overturn advertising bans on a regular basis.

Despite these complexities, pharma in the US has recently overtaken tech to become the second-largest industry for ad spending in 2023, seeing a $17 billion leap in ad spend over the last ten years. The industry now invests around $18 billion a year in advertising. “There's something happening with this category that is really hot,” Darrick Li, VP of sales in North America at Standard Media Index (SMI) said. “Spending by pharma is actually up across all media types, but the fastest rate of growth is coming from mediums like out of home and digital.” The SMI reported seeing digital media in 2022 for the first time, accounting for over half of all prescription drug ad spend. OTC became over 50% digital back in 2021. Globally, pharma spent around 54$ billion over 2022, an increase of 16% from the previous year, but a massive +55% from around five years ago.

Pharma advertising is big business but with so many additional elements to consider, it’s not surprising that it hasn’t previously been known for embracing innovative change in its communication and channel use. Pharma was a category on higher alert than most during the pandemic, and was forced to make changes very quickly, with marketing events and global conferences forced to cancel. The industry, like others, moved at speed to adopt new and creative uses of digital marketing to communicate during this period.

Where should you focus your pharma advertising?

Best practices emerging from research of our Kantar database of LINK+ ad testing will help you navigate your way around the myriad of opportunities presenting themselves in this category. So what do we know about pharma advertising?

Around 4% of all ads researched at Kantar are for pharma brands. Of the ads we test, 65% are for OTC products, with the rest DTC prescription products. This equates to the research of thousands of pharma ads across a multitude of media channels. Within these, we see digital/social ads performing slightly better than TV overall, while print and outdoor ads can work well to engage and build brand equity. And with a new openness of ideas bubbling around the pharma industry, we are seeing doors being opened to other forms of advertising. For example, a +208% jump in spending on podcast pharma ads was seen at the start of 2023.

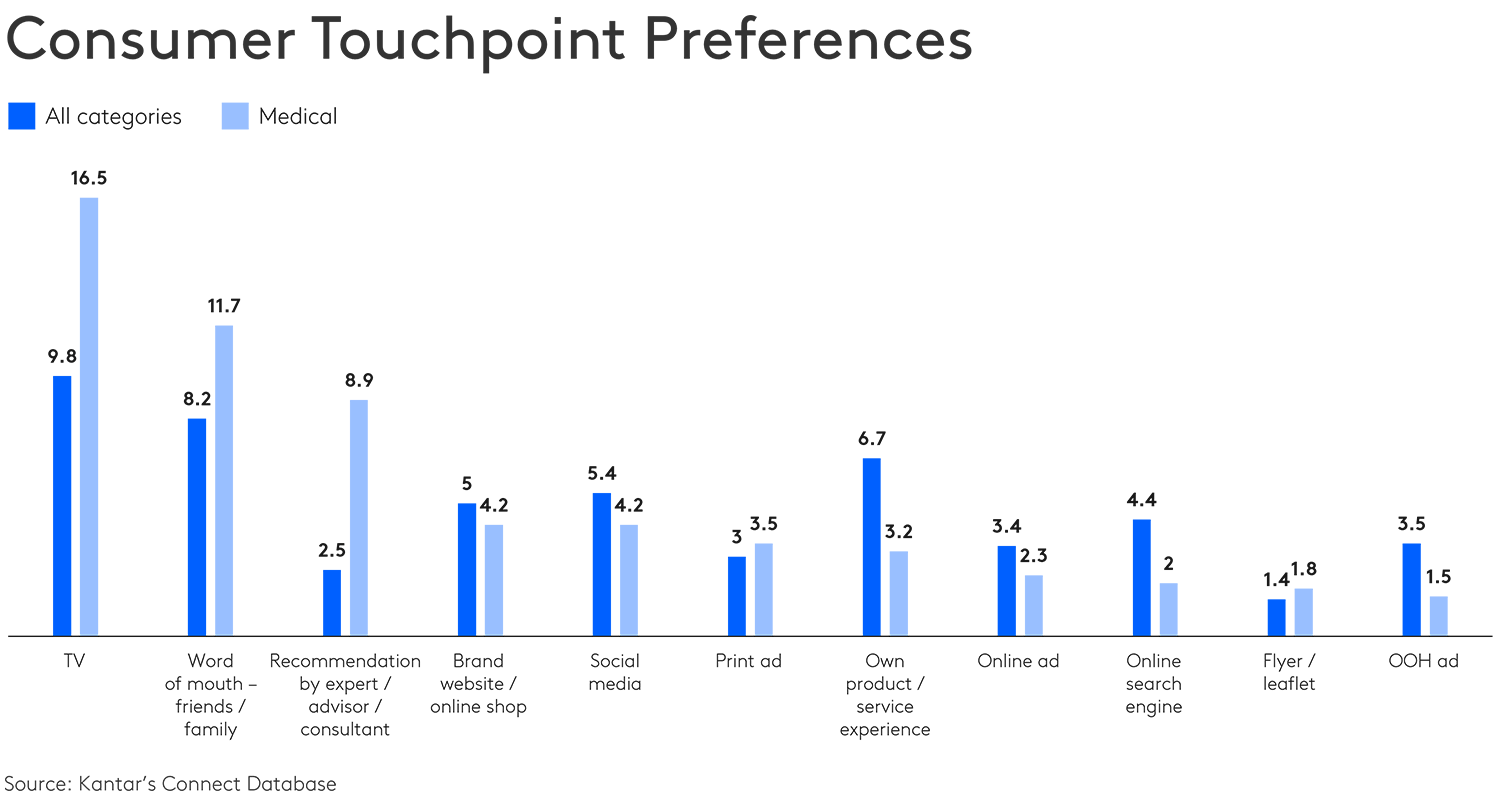

A further meta-analysis of our touchpoint strategy solution Connect shows that the top areas for pharma brand strength are through TV ads, and word of mouth. Word of mouth is a combination of real-life experience and recommendations from friends and family, but in pharma, recommendations by experts, advisors or consultants are also important ways to reach out to your consumers

How do pharma ads compare on measures of effective advertising?

The overall key to effective advertising for any ad is to be distinctive; well-branded; convey meaningful difference; and trigger the right emotions. BrandZ data by category shows pharma brands falling around average when it comes to ‘having great advertising’. Further in-depth data from our LINK+ database highlights more specific strengths and weaknesses. Pharma’s strength lies in its ability to meet consumers’ needs, here we see a +21 point increase from average, along with persuasiveness which lands +15 points above average. The main weakness we see is a lack of enjoyment, which you may think unsurprising this is medicine after all, we’re not supposed to ‘enjoy’ it, are we? The answer is why not? category isn’t relevant when it comes to consumers enjoying and engaging with clever creative content that conveys its message well. There should be no barriers when it comes to producing great creative, fear of appropriateness is all that holds some back, and if this is the case, a fast and flexible LINK+ test is an easy check to ensure your creative is landing well and as intended.

Branding is another weaker area for pharma ads, falling slightly below average, but can be addressed by inclusion of various features that we see pharma ads sometimes failing to include.

At a regional level, pharma ads from North America tend to be stronger than other regions and within these OTC ads out-perform DTC on performance marketing specifically. Both do well on long-term building of future brand demand. Across all regions we see an ability of pharma ads to meet people’s needs and build brand affinity.

So, what does great pharma advertising look like?

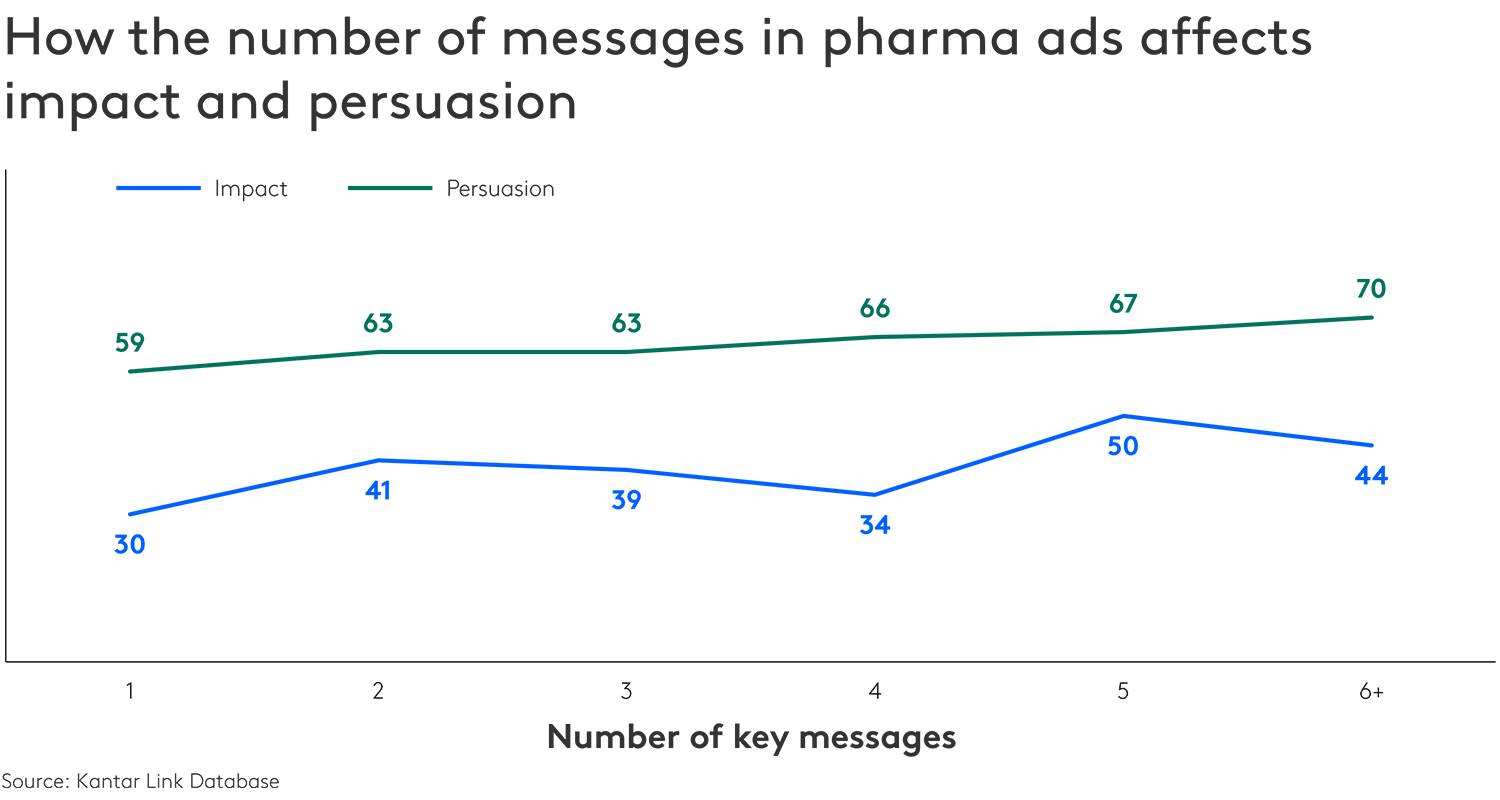

Because of the legalities that need to be communicated on top of any brand messages, pharma ads are one of the categories most likely to have multiple messaging. Around two thirds (65%) of pharma ads contain 3 or more messages (automobiles are the only category with similar levels). In general, we have always seen ads with multiple messages finding it harder to land each individual message well, but in pharma this looks to be less of an issue, especially in terms of persuasiveness. Pharma differs slightly from other categories in seeing a constant increase in persuasion as the number of messages increases. I’m sure there is a saturation point, but clever creative content can ensure effectiveness even when multiple messaging is essential as it does tend to be in this category.

Something else we have noticed across pharma ads at Kantar is an overall tendency to show the product itself less often throughout the ad, yet continuous showing of the product is more common amongst the ‘most’ impactful pharma ads. Similarly, demonstrating the product being consumed or used is less common overall in pharma, but again, the most persuasive pharma ads make greater use of these types of product demonstrations. Tylenol is a great example of a pharma ad that uses over-dramatization of the symptoms, to clearly demonstrate the products benefits in a memorable and humorous way. A previous Kantar Creative Effectiveness Award winner from Panadol is a clever example of an ad making sure the product itself is shown continuously throughout the ad. We also see less use in pharma of slogan repetition, yet twice as many of the most impactful pharma ads are using slogans that have been used before when compared with less impactful pharma ads.

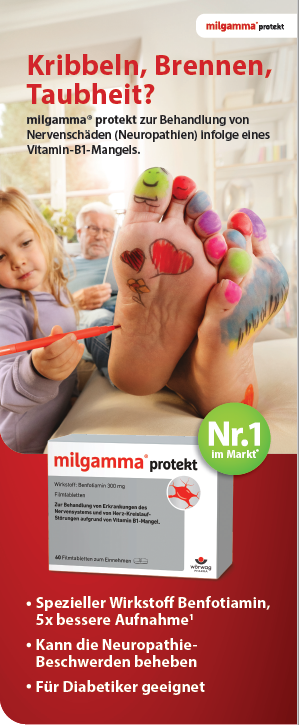

One of the other key features that pharma tends to shy away from is humour. Pharma falls down on overall enjoyment compared with other categories. Only 21% of pharma ads are designed to be humorous compared with an average of 37% seen in other ads. In my recent article Starting to laugh again, I highlighted the fact that there are absolutely no barriers to the use of humour in advertising, and that includes pharma brands, despite the often serious nature of the subject matter. It’s all about doing it well and ensuring appropriateness. Take this great example from United Healthcare bringing fun and entertainment to the world of health insurance. And humour can be a great way to creatively approach sensitive medical subjects, such as in this KCEA print winner for Milgamma Protekt Vitamins. The ad utilizes the fun painting of grandad’s feet, that he hasn’t noticed, to highlight the products core message of numbness being a possible sign of nerve damage.

So, despite pharma not being an ‘easy’ category with all the complexities it brings, there really are no excuses when it comes to producing great pharma ad campaigns. A growing category in the ad industry, with more money than ever before now being put behind it, along with a revised mindset opening up to new and innovative ways of connecting with consumers, pharma is currently riding the crest of an advertising wave when it comes to possibility, shape your brand future by ensuring that you, come along for the ride.

For further help, visit the 2023 ranking of the most valuable global pharma brands and the key factors behind their growth in the latest global report. And for an overarching view of a brand’s performance, Kantar has launched a new, free interactive tool using BrandZ’s wealth of data. BrandSnapshot powered by BrandZ delivers intelligence on 10,000 brands in more than 40 markets, offering a quick read on a brand’s performance within its category.