Take-home sales at the grocers grew by 4.1% over the four weeks to 5 October versus last year, according to our latest data. Like-for-like grocery price inflation rose to 5.2%, matching the level recorded in July.

Households are juggling a lot of different things when choosing what and where to buy their groceries. Inevitably, cost will be up towards the top of the list as price rises accelerate. Spending on offers has hit its highest level since April at 29.4%, as consumers hunt for deals to ease the burden on their wallets. Promotions often jump in the run up to the festive season so it’s likely the trend will continue as we get closer to December.

Consumers care, but don't always want to pay

However, it's not just price on shoppers’ minds, our data reveals how consumers and retailers are balancing concerns around health and sustainability too. In October, new regulations came into force in England restricting multibuy* deals on products high in fat, salt or sugar (HFSS). Retailers have had this HFSS legislation in their sights for several years and they’ve been adapting, with consumer habits already shifting as a result. Three years ago, 28% of promotional spending on crisps was through multibuy offers but it’s come right down since then to just 8% in the month to 5 October. There's a similar story in the cereal aisle with promotional spending on multibuy deals down from 18% to 5% during the same time period.

On the subject of sustainability, new Worldpanel research** shows that 50% of British shoppers believe that environmental issues are a critical threat to humanity, with the potential to shape the way they shop. People are worried about environmental issues but the data uncovers a growing sense of pessimism among consumers about their ability to really make a difference. There’s an opportunity for brands and retailers who can make it easier to make sustainable choices and people seem to be willing to adapt. One in two say they would accept plainer packaging for a product that they trusted was better for the environment, while 54% would even be willing to bring their own packaging. However, value for money is still a big consideration and just 9% of people are happy to pay more for items that are better for the planet. Only 3% say they would compromise on quality. Interestingly, concerns about microplastics are on the rise, with over 40% of British households saying they are increasingly worried about the impact on their health.

Online share reaches three year high

Online sales at the grocers grew by 12.0% compared with the same four weeks last year, making up 12.7% of the market – the highest share since March 2022. Over one in five British households did their grocery shopping online at some point in September, marking a return to the popularity seen in the latter stages of the Covid-19 pandemic.

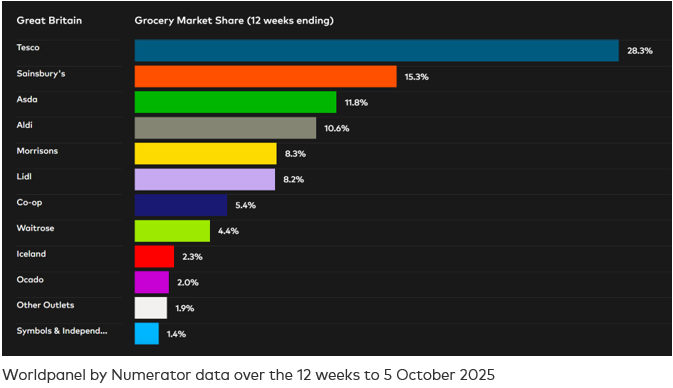

Online specialist Ocado remains Britain’s fastest growing grocer, with sales rising by 13.6% over the 12 weeks to 5 October versus the same period a year ago. The retailer now holds a 2.0% share, matching its previous record high. Lidl also saw double digit growth, as sales grew by 10.8%. This takes the discounter’s market share to 8.2%, up by 0.5 percentage points.

Tesco once again made the biggest share gain, climbing by 0.7 percentage points to take 28.3% of the market. Spending through its tills increased by 6.9%. Sainsbury’s boosted its sales by 5.2% and lifted its market share to 15.3%.

Aldi maintained its 10.6% portion of the market as spending rose by 4.3%, while Waitrose’s share held stable at 4.4% after increasing sales by 3.7%.

Asda and Morrisons now take 11.8% and 8.3% of the market respectively. Market share for convenience specialist Co-Op stands at 5.4%, while spending at Iceland outpaced the market as it retained 2.3% of overall spending. Sales of groceries at M&S*** were 7.7% higher over the 12 weeks.

*Multibuy, Y for £X and extra free promotions

**Who Cares? Who Does? (Sustainability) survey by Europanel in combination with Worldpanel by Numerator and YouGov, 9,865 households, June 2025