The latest take-home grocery sales in Ireland rose by 4.5% in the four weeks to 30 November 2025, according to our latest data, down slightly from last month (5.5%). Despite prices continuing to rise, shoppers spent an additional €56 million on groceries but spent less time in-store compared to the same period last year, down 1.3%.

While grocery price inflation stands at 6.0%, falling slightly from last month’s 6.5%, Irish consumers, are looking for a mix of quality and value rather than chasing the lowest price when stocking up on festive favourites.

Christmas is no longer on the horizon, it’s just days away and we’re seeing the final surge in shopper behaviour. This is the time when convenience, speed and last-minute decision-making dominate. With busy social calendars, shoppers are prioritising quick wins with ready-to-go gifts, easy meal solutions and anything that saves them time. For brands and retailers, this is the critical window of opportunity to capture those indulgent impulse purchases, making sure they are well stocked with big-day favourites and can guarantee availability.

Brands enjoy a festive boost as shoppers indulge

At this time of year, shoppers aren’t necessarily looking at price. While promotions play a role, this season is about more than discounts. Many are looking to indulge a bit, despite cost-of-living pressures, and this is reflected in consumer choices, including choosing more brands to enjoy over the Christmas period.

The latest data shows that brands hold the highest value share seen since January 2025 at 49.9% with shoppers spending nearly an additional €96 million on branded ranges versus last year. An additional €2.1 million was spent on branded seasonal chocolate compared to last year.

Own label saw strong growth over the last 12 weeks, up 5.3%, with shoppers spending an additional €82.6 million on these ranges versus last year. Premium own label ranges continue to see strong growth, up 10.7%, with shoppers spending an additional €13.8 million on these ranges compared to last year.

Rising cost of Christmas dinner

Christmas dinner is marginally dearer than last year, which was €31.22 for a family of four and now costs €32.28. Retailers have been putting emphasis on own label ranges and promotional lines to help people manage their household budgets.

What we’re seeing is essentials like vegetables going down in price, but an increase in turkey and seasonal sweet biscuits, which is nudging up the overall price of the Christmas dinner. But for many shoppers, festive indulgence remains a priority. For example, despite chocolate prices rising 13.5% compared to last year, almost one in four (24%) of households still picked up a selection box in November.

Retailer and channel performance

Online continued to grow, at a significantly faster rate compared to last month, up 6.7% year-on-year to take 6.2% value share of the market. Shoppers spent an additional €14.4 million online during the period, helped by larger and more frequent trips, which contributed a combined €14.7 million to their overall performance. Nearly 18% of Irish households bought their groceries online during this time.

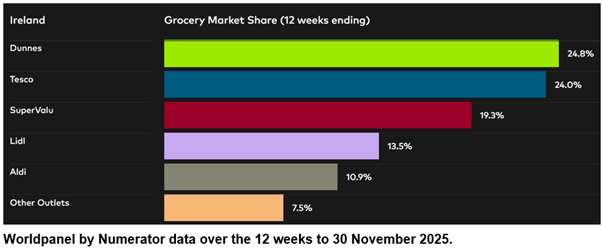

Dunnes holds 24.8% market share, up on the last 12-week period, with sales growth of 5.2% year-on-year. Larger and more frequent trips contributed an additional €24.9 million to their overall performance.

Tesco holds 24% of the market, with value growth of 7.2% year-on-year. An influx of new shoppers contributed an additional €25 million to the grocer’s overall performance.

SuperValu holds 19.3% of the market with growth of 2.3%. Consumers made the most shopping trips to this grocer, averaging 23.6 trips over the latest 12 weeks. SuperValu recruited new shoppers to store over the latest 12 weeks, which contributed an additional €12.7 million to their overall performance.

Lidl holds 13.5% of the market with growth of 9.4%, the fastest growth among all retailers once again. Lidl also saw not only new shoppers in-store but existing shoppers pick up more volume in store, contributing a combined an additional €17.7 million to overall performance.

Aldi holds 10.9% market share, up 2.5%. Increased store trips and new shoppers drove an additional €8.8 million in sales.