Predicting future shopping behaviour has always been a huge challenge for the FMCG industry. But following the unprecedented events of the past 18 months, it seems almost impossible to say how people will behave tomorrow – let alone in six months’ time. Looking at UK, France and Spain, we know there are certain trends and behaviours that have changed as a result of COVID-19.

How is shopper behaviour changing?

All three countries recorded their first cases in January 2020, imposed strict national lockdowns in March 2020, and have battled through several waves of the virus so far.

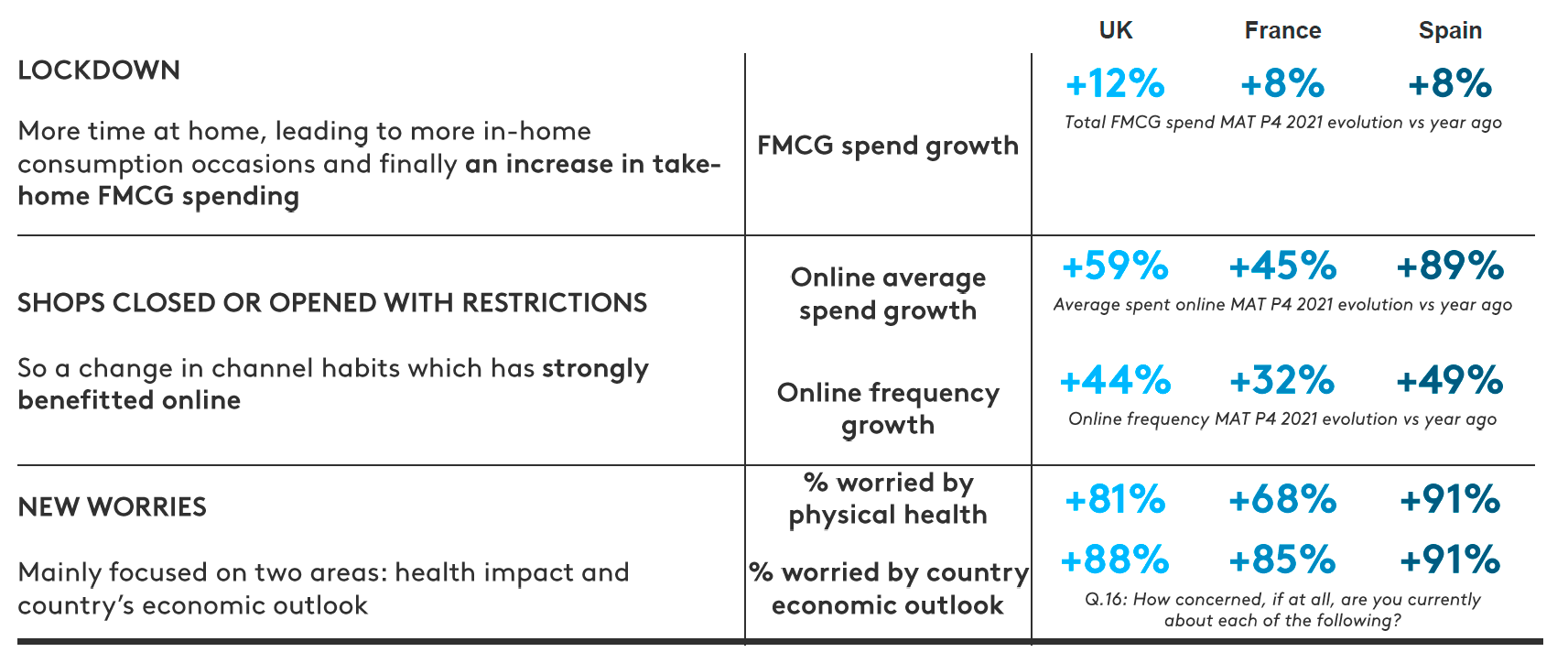

We know that similar trends in shopper behaviour emerged during the pandemic – from spending more on take-home FMCG due to restrictions on movement, to the rise of online caused by fears over visiting physical stores.

There also seems to be some crossover when it comes to shoppers’ fears over the future, with health and the economy dominating concerns in all three countries.

But despite the clear similarities in experience and behaviour between the three countries, there are a number of important differences that make it difficult to create a joined-up strategy.

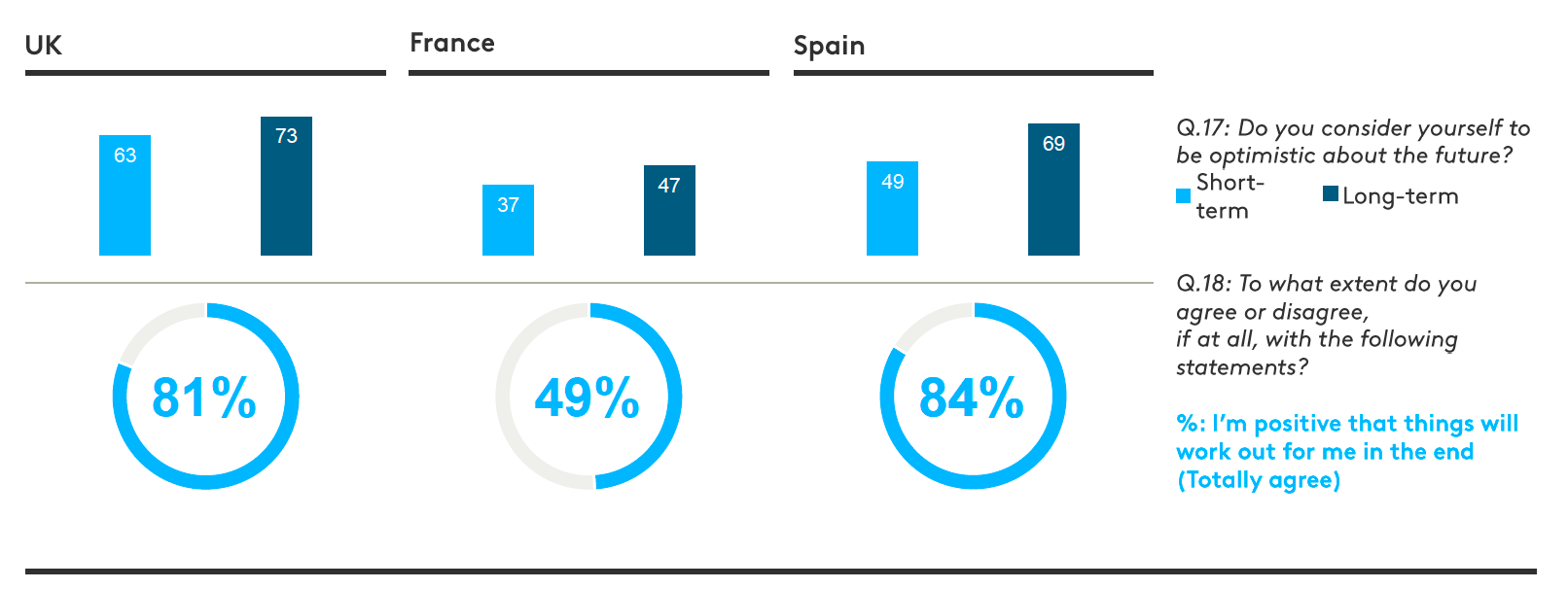

For example, the level of optimism for the future is not consistent across the countries. As the below chart shows, shoppers in Great Britain and Spain are far more positive in their outlook – both in the short and long term.

At the same time, the level of pessimism doesn’t necessarily equate to the potential impact on the shoppers’ working situation. French shoppers, for example, faced less disruption to their daily working lives during the pandemic – yet are far less optimistic about the future. Furthermore, while more than half of shoppers in the UK (57%), France (55%), and Spain (64%) intend to change their purchasing behaviour following the pandemic, the reasons for doing so vary greatly.

In the UK, the most important factor influencing purchasing decisions is enjoyment (59%), whereas it is low price and promotions in France (32%), and health benefits in Spain (28%). These factors paint a complex and nuanced picture of how shoppers across markets will behave post-pandemic.

With this in mind, we have conducted some shopper research. We asked shoppers across these three key markets (the UK, France, and Spain) how they have been impacted by the pandemic – and how they feel they will be impacted in the future.

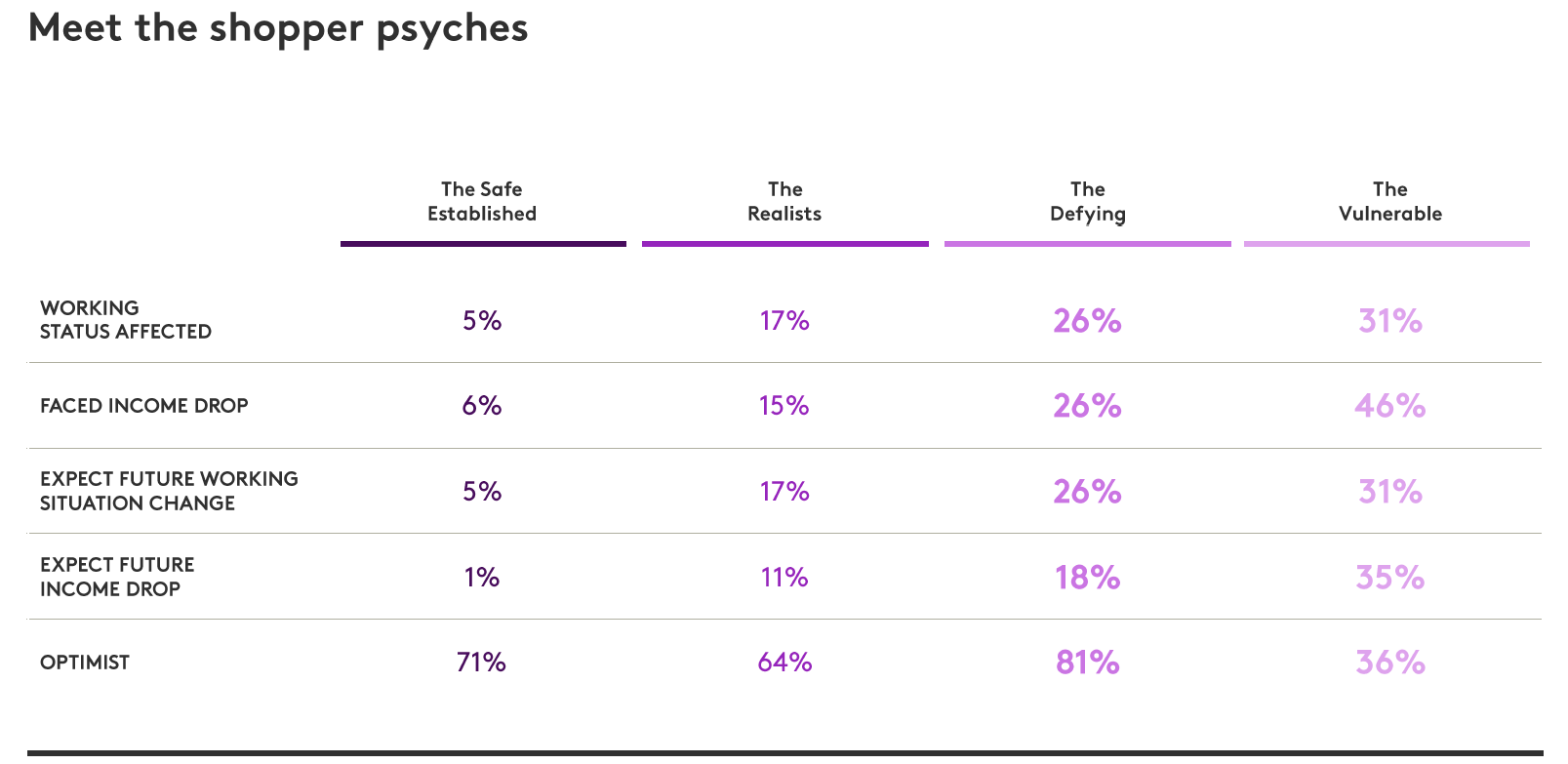

Based on their responses to these questions, we have developed a new way of viewing these shoppers, by segmenting them into four shopper psyches. These psyches encompass the shared beliefs of these groups across markets. In this way, it is possible to create a single strategy that targets the most important personas for your brand.

1. The Safe Established

Tends to be older, retired and within a single or two-person household. They have more disposable income and are generally from higher social classes. Their working status and income weren’t disrupted by the pandemic, and they are generally optimistic about the future (with the figure sitting at 71%). They strongly trust brands and retailers to play a role in economic recovery. In the future, they want to shop more locally.

2. The Realist

Tends to be younger and have a family of their own. They generally work and are from higher social classes. Their working status and income were slightly disrupted by the pandemic, but they are still not too worried about the future (only 11% expect a future income drop). They don’t really trust brands and retailers to play a role in economic recovery. In the future, they want to shop more locally.

3. The Defying

Also tends to be younger and have a family of their own. They generally work and are from middle class groups. Their working status and income were significantly disrupted by the pandemic, and they don’t expect their situation to improve any time soon. However, they are greatly optimistic that everything will work out in the end for them (81% are optimistic about the future). They also strongly trust brands and retailers to play a role in economic recovery. In the future, they want to shop more locally and use discounters to search for lower prices.

4. The Vulnerable

Tends to be middle aged and usually has a family of their own. They are a mix of workers, retired and unemployed people who are generally from lower social classes. Their working status and income was the most significantly disrupted out of all the groups, and as a result they are very pessimistic about the future (only 36% are optimistic about the future). They also don’t trust brands and retailers to play a role in economic recovery. In the future, they will shop more in discounters to search for lower prices.

How does the shopping behaviour of these psyches differ?

Looking at the real shopping behaviour of our groups, we see some significant differences – in terms of how much they spend, where they shop, what they buy – and the effect of the pandemic on these choices.

For example, in Great Britain, all four groups increased their FMCG spend. But it was The Realists that increased their spend the most (+16%) compared to The Safe Established and The Vulnerable, who only increased their spend by 7.6%.

Perhaps more interesting is looking at their spend within the Beauty & Personal Care sector, which suffered as a consequence of people going out less. For this sector, The Defying, and The Vulnerable both spend significantly more than the average, however the former only spent 1.5% less, whilst the latter spend 8% less in the last 12 months.

In France, when we looked at where the groups shopped for FMCG, we saw an increase across the board in online shopping. However, the differences in the share gained by the channel ranged from 1.2% to 2.4%, with The Safe Established seeing the smallest uplift and only spending 4% online (compared with the 8.2% national average).

In Spain, there has been a sharp rise in the amount spent on organic produce. But, despite the biggest increase coming from The Realists (+14%), the most important group for organic food remains The Safe Established, who spend 39% more than the average shopper.

Understanding these differences in purchasing behaviour can help unveil new opportunities that may not appear through traditional demographic lenses. Here’s an example in practice.

How Shopper Psyches helped differentiate two ‘similar’ beer brands

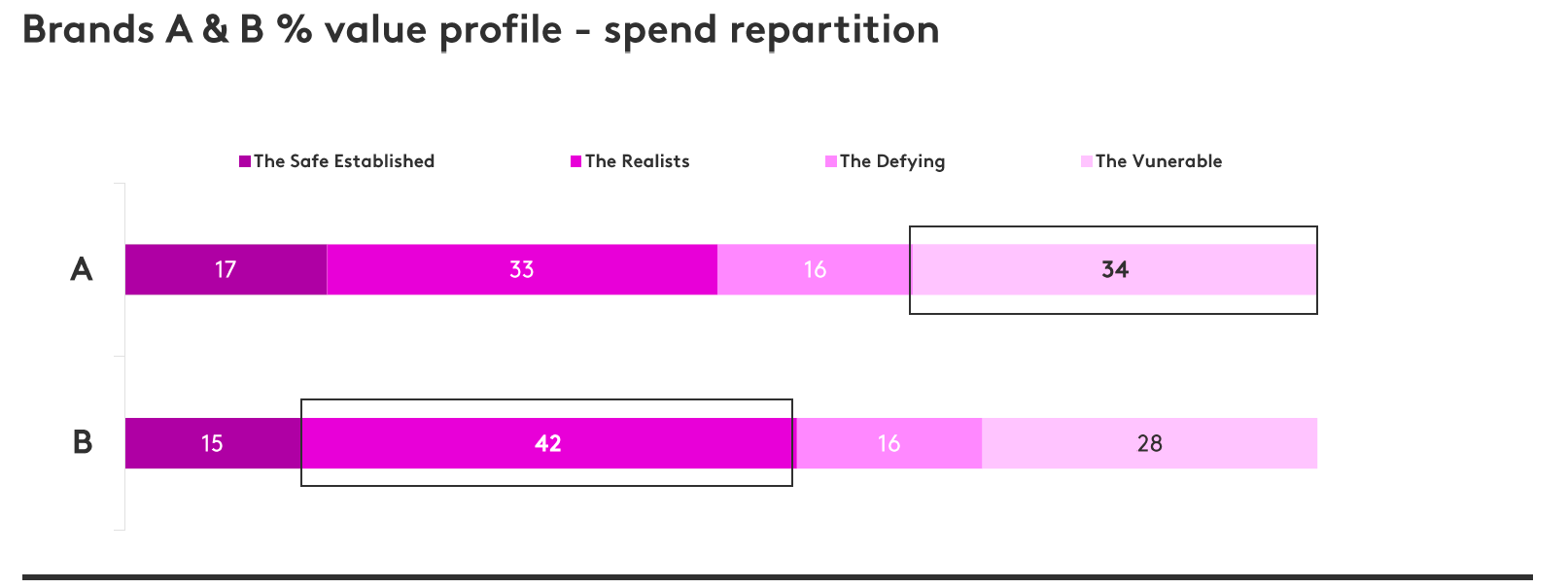

To understand how you can use these psyches to inform your strategy, below is an example of two famous French beer brands. Both brands have a similar market share, positioning, and demographic profile. But, by looking through our shopper psyches lens, you can see that Brand A is more dependent on The Vulnerable, while Brand B is more dependent on The Protected.

From this information, we can generate a risk score and provide recommendations on how to adapt your strategy to attract these psyches to your brand. For example, for Brand A we would recommend offering promotions and targeting discounters as part of your channel mix.

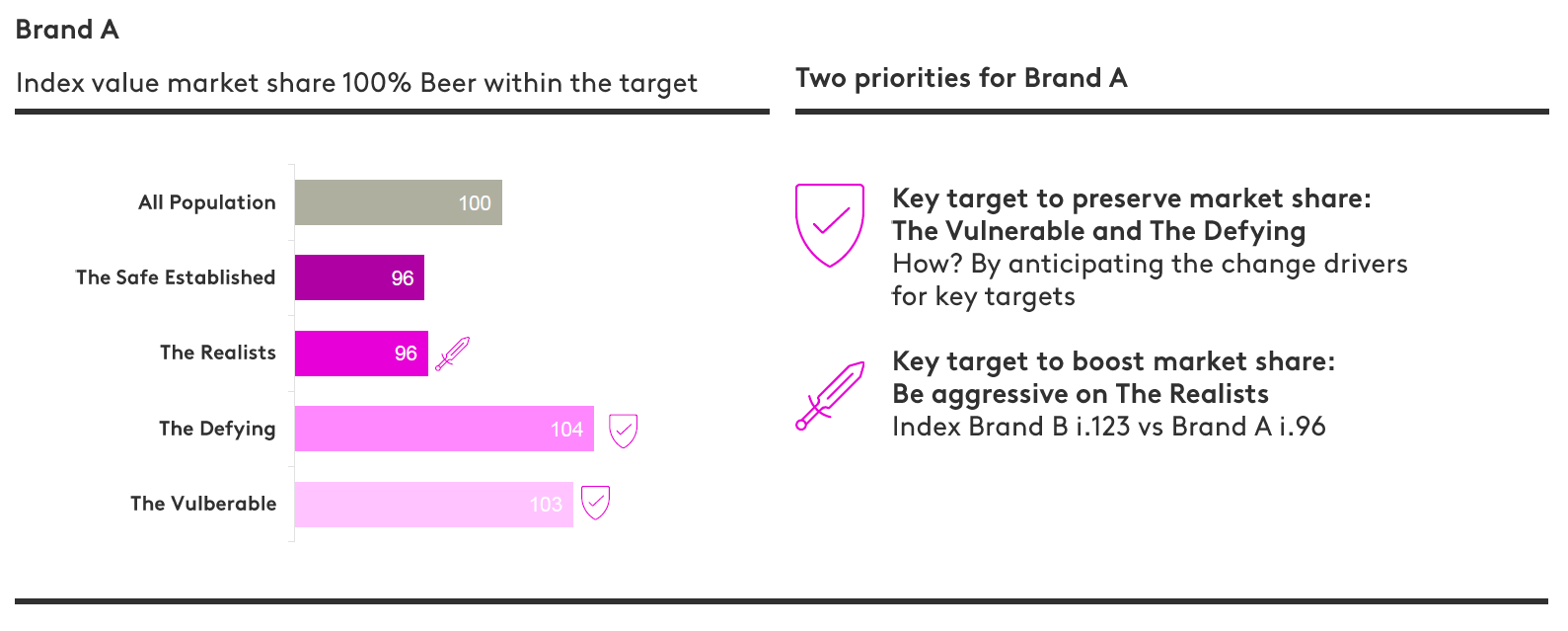

We can also use this to detect where the white spaces are in terms of attracting new shoppers to your brand. As you can see below, Brand A has an opportunity to be more aggressive in targeting The Realist group – whilst preserving market share amongst The Vulnerable and The Defying groups.

To find out more about how your brand can use the shopper psyches to plan for the future, please join our webinar or contact our expert for more information.