Our latest data shows that take-home grocery sales in Ireland increased by 7.2% in the four weeks to 29 October 2023. While shoppers visited stores more often in October with an average of 20.1 trips over the month (up 3.6%) volumes per trip continued to decline versus last year (down 5.9%).

Grocery inflation sits at 9.8% in the 12 weeks to 29 October and provided welcome news for consumers as it dropped into single figures for the first time this year.

This is the sixth month in a row that there’s been a drop in inflation, although it’s still high. Compared to last month’s inflation rate of 10.5%, there has been a significant drop of 0.7%. The positive news is that this is the lowest inflation level we have seen since September 2022, and we expect this to continue to decline over the coming months.

The percentage of packs sold on promotion rose slightly by 0.4% compared to last month. The percentage of sales sold on promotion currently stands at 24.8%, up 6.9% year-on-year and the highest level seen since August 2023.

Own label value share stands at 47.5%, with brands holding 47.4%, which is up 0.6% on last month.

Irish shoppers are looking out for the best deals and own label goods remained popular over the last 12 weeks, with sales up 11% compared to brands at 6.2% (+1.1% on last month). Premium own label ranges had the strongest growth, up 12.1% with shoppers spending an additional €14.8m year-on-year. It looks like shoppers may be trying to temper their spend and seek savings now through own label lines so they can splurge on the upcoming holiday season.

Festive season drives up indulgent spending

As the festive season approaches and Christmas hits the supermarkets early, consumers are already reaching for more branded and premium own label products. More indulgent categories are benefiting as a result, with seasonal biscuits and take-home confectionery all seeing more accelerated growth rates on promotion year-on-year.

The general outlook is slowly starting to improve for Irish consumers, with Kantar’s latest pressure group survey revealing that 16% of Irish households expect their finances to improve in the next 12 months.

Online sales remained strong over the 12-week period, up 28% year-on-year with shoppers spending an additional €39.6m on the platform. More frequent trips up 2.6% and new shoppers up 2.4 percentage points have contributed to online’s overall growth.

Irish retailer performance update

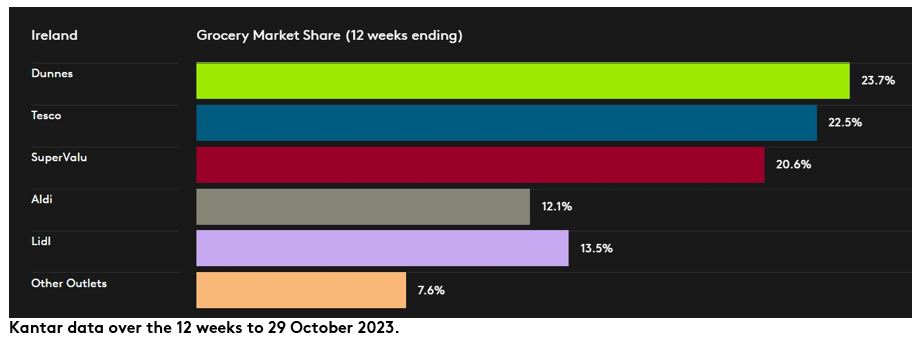

Dunnes, Tesco and Lidl all grew ahead of the total market in terms of value this month.

Dunnes holds 23.7% with growth of 10.8% year-on-year and a boost in new shoppers, up 2.33 percentage points, contributing an additional €23.9m to their overall performance. Dunnes welcomed the strongest growth in new shoppers and volume per trip among all the retailers.

Tesco holds 22.5% of the market with 11.3% growth year-on-year. Tesco had the strongest frequency growth among all retailers once again, up 13.1% year-on-year, alongside new shopper arrivals, which contributed an additional €81.7m to their overall performance.

SuperValu holds 20.6% of the market with growth of 6%. SuperValu shoppers made the most trips in store amongst all retailers on average 22.3 trips alongside an increase volume per trip, which contributed an additional €32.6m to their overall performance.

Lidl holds 13.5% share with growth of 10.7% year-on-year. More frequent trips contributed to an additional €43.1m to its overall performance. Aldi holds 12.1% with growth of 2.6% year-on-year, while more frequent trips contributed an additional €25.9 to its overall performance.

Want more like this?

Read: Grocery inflation drop drives Irish shoppers in store

Read: Grocery price inflation in Ireland falls for fourth month in a row