Grocery price inflation increased slightly to 2.0% during the four weeks to 29 September, up from 1.7% last month, according to the latest data from Kantar. Take-home sales at the grocers grew by 2.0% over the same period.

The findings, which come ahead of the Chancellor’s autumn budget, showed that spending on promoted items continued to rise, climbing by 7.4% in September as households sought to manage their finances. By comparison, full price sales nudged up by 0.3%. Despite the annual rate of grocery inflation growing, the contest between the grocers to attract shoppers through their doors has seen prices roll back on some essentials.

In the fiercely competitive retail sector, the battle for value is on. Supermarkets are doing what they can to keep costs down for consumers and thanks to their efforts the prices in some categories are falling. The average price paid for toilet and kitchen roll is 6% lower year-on-year, for example, while dog and cat food are 4% and 3% cheaper respectively.

With spending still stretched, people are having to make decisions about what they can afford, with more consumers reporting that they are struggling to balance environmental concerns with their own financial worries. 59% of Britons now say they’re finding it harder to act sustainably, up from 44% last year.*

Warming up as the rain came down

Much of the UK saw record monthly rainfall in September, impacting how people shop. Fraser McKevitt continues: “The unusually wet weather this September had the nation rushing for those classic warming staples. Hot chocolate sales surged by 28%, soup by 10% and home baking by 7% as people looked to stave off the autumn blues.

Halloween seems to be on some shoppers’ minds early, and retailers will be hoping for a spooky season sales boost. Pumpkins are flying off the shelves, with sales nearly doubling last September’s figures, at just under £1 million over the last four weeks. Sugar confectionery has also seen a 9% lift, with sales expected to ramp up further this month as trick or treating approaches – confectionery sales were 16% higher in the second half of October last year.

Ocado and Lidl fastest growing retailers

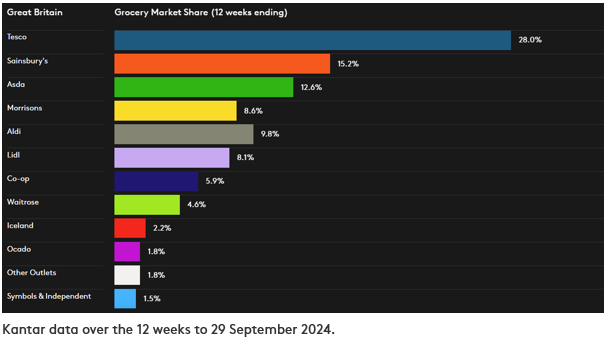

Britain’s biggest supermarket Tesco achieved its largest share since December 2017. It now takes 28.0% of the market, up from 27.4% one year ago. Sainsbury’s’ sales increased by 5.1%, with its market share stepping up 0.4 percentage points to 15.2%. Asda’s hold of the market is now 12.6%.

Ocado was the fastest growing grocer for the eighth month running, pushing its sales up by 10.0% over the latest 12 weeks. The online specialist’s market share grew by 0.1 percentage points to 1.8%. The overall online market expanded by 3.5% over the 12 weeks, now worth £3.7 billion, with 22.1% of households shopping online.

Spending through Lidl’s tills climbed by 8.8%, with the discounter adding 0.5 percentage points to its share of the market – bringing it to 8.1%. Sales at Aldi, Britain’s fourth largest retailer, account for 9.8% of spending at the grocers. Meanwhile Morrisons makes up 8.6% of the market, the same proportion as a year ago.

Both Waitrose and Iceland’s market share held steady at 4.6% and 2.2% respectively. Convenience retailer Co-Op now has a 5.9% share.

* Source: Kantar – Who Cares? Who Does? Sustainability report 2024. GB sample size 9,516