In the first article in our series on brand equity we argue that consumers hold in their minds many associations with brands. The strength of these associations is a brand’s ticket in a purchase situation; the faster a brand comes to mind, the more likely people are to buy it – this is why mental availability matters. When it comes to long-term brand building and sustainable growth, creating an emotional connection with people is key. Such connection further influences consumers’ intention to buy; it creates a lifetime advantage that predicts purchase behaviour, accelerates growth and can help support a price premium. This is why a brand shouldn’t merely be famous, but also meaningful and different.

In this article we go further to look at why it’s important for brand owners to understand and measure their brand equity, and how they can do this.

To measure or not to measure

It feels intuitive to proceed with the cocktail of KPIs that guarantee to grow your brand equity detailing the optimum tracking frequency for each. But, V. F. Ridgway’s 1956 paper, tellingly titled: “Dysfunctional Consequences of Performance Measurements” rings in my head. It’s true: not everything that matters can be measured and not everything that can be measured matters. However, brand equity does matter, it can and should be measured. Why? Because it’s “brand magic” as Dom Boyd says – a fundamental step to ensuring brand marketing is hardwired into the business’ future growth strategy. And in its practical application, it’s a process; a tracking process that enables marketers to quantify and celebrate accomplishments in the boardroom, but also, crucially, to gain and retain stakeholder buy-in through commercial alignment and the ability to predict future outcomes.

Your brand is one of your business’ most valuable assets

Many companies out there are measuring the financial value of brands. What we uniquely say though is that a brand’s equity in the minds of the consumers is the game-changing multiplier in the calculation of a brand’s value. Kantar’s BrandZ measurement methodology accounts for the intangible perceptions that consumers have for a brand over and above the tangible assets on the company’s balance sheet. Simply put, including brand equity in financial valuation shows the future contribution that investment in the brand is making.

The annual BrandZ rankings are ‘the Oscars’ of marketing effectiveness – the more you have strengthened your brand, the better it can navigate through market storms and new category arrivals, the faster it grows, the more valuable it is. BrandZ’s approach is distinct in peeling away all the financial and other components of brand value and getting to the core – how much the brand itself contributes to enterprise value. And it does this through the uniquely validated metric of Brand Power.

What is Brand Power and its relationship to sales?

Meet Brand Power, the great surrogate for understanding and quantifying long-term sales. It’s worthy of such introduction as it closes the gap between perception and reality. It is a simple, yet comprehensive set of brand equity metrics that explain and predict a brand’s market reality – as myriads of our analyses show.

The BrandZ top 100 most valuable global brands remained unfazed by the decline in global economy (2019-2020: -3.3%) and continued to thrive, enjoying a brand value increase of 5.8% in 2020. Meaning they continued to sell strongly amidst turbulence.

How did they do it?

Brand Power’s ‘secret sauce’ has been discussed (and praised) by well renowned (and less biased than me) brand consultants. The industry has moved on from the “differentiate or die” mantra of 30 years to one that “combines salience and meaningful difference”, Mark Ritson says in his bothism as cure for marketing article, adding that “Kantar has been politely proving for years that such combination is greater than the sum of its parts.”

So, 1 + 1 + 1 > 3. But what do we mean by each term?

- Meaningful: this brand meets people’s needs and they feel emotionally connected to it

- Different: this brand is perceived as a trend setter for its category, as unique

- Salient: a brand that comes to mind quickly in a purchase situation

Brands that are meaningful AND different AND salient:

- have the power to capture significantly more volume

- can command a price premium

- have much greater potential to gain value share in the future

The combination of all three is the holy grail for brands; the proof is undeniable:

-

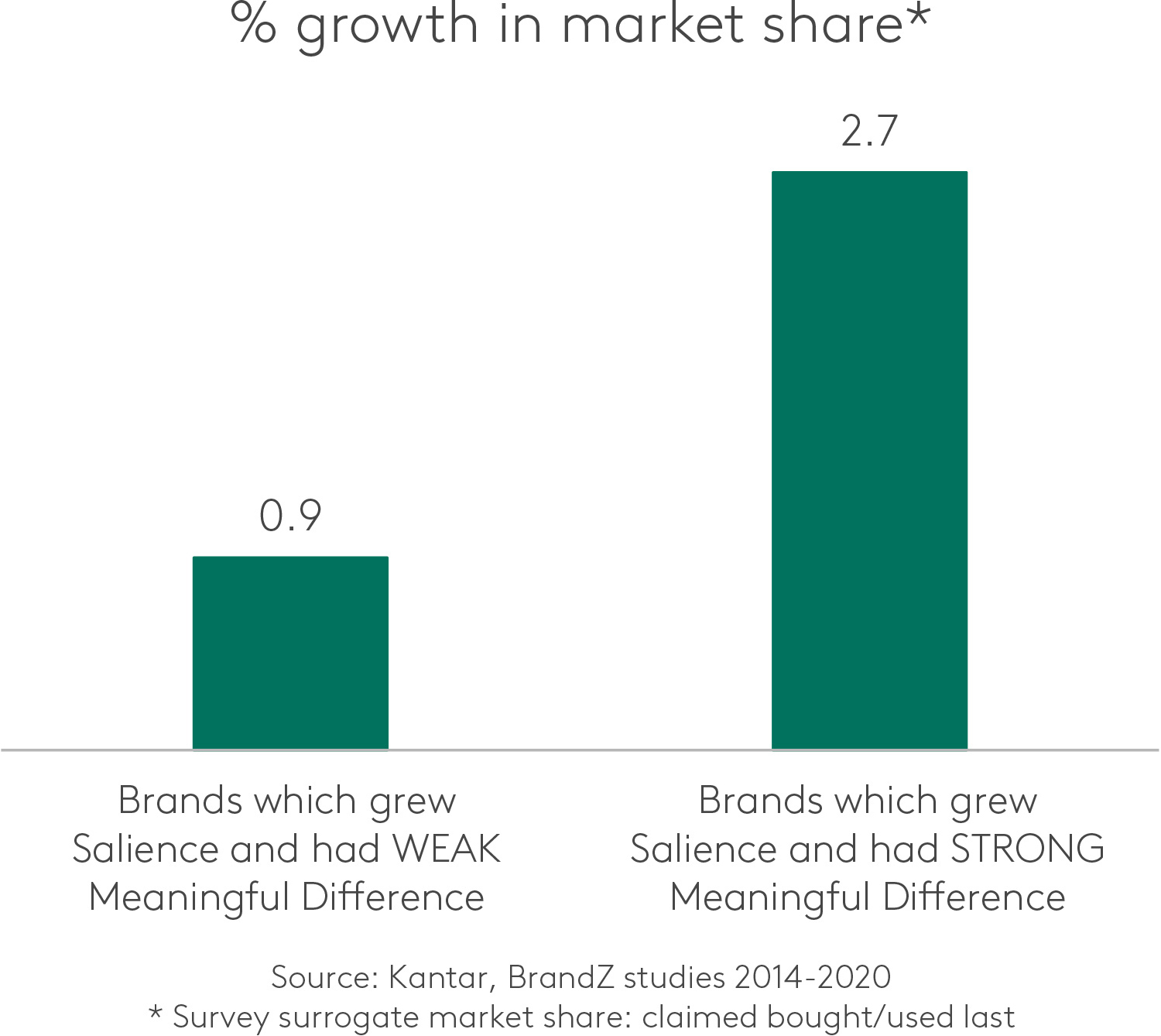

Meaningful difference gives salience wings. Growing salience from a position of strong equity gives three times the market share gain compared to a starting point of weak equity; marketers should, therefore, seek first to define and build meaningful difference.

-

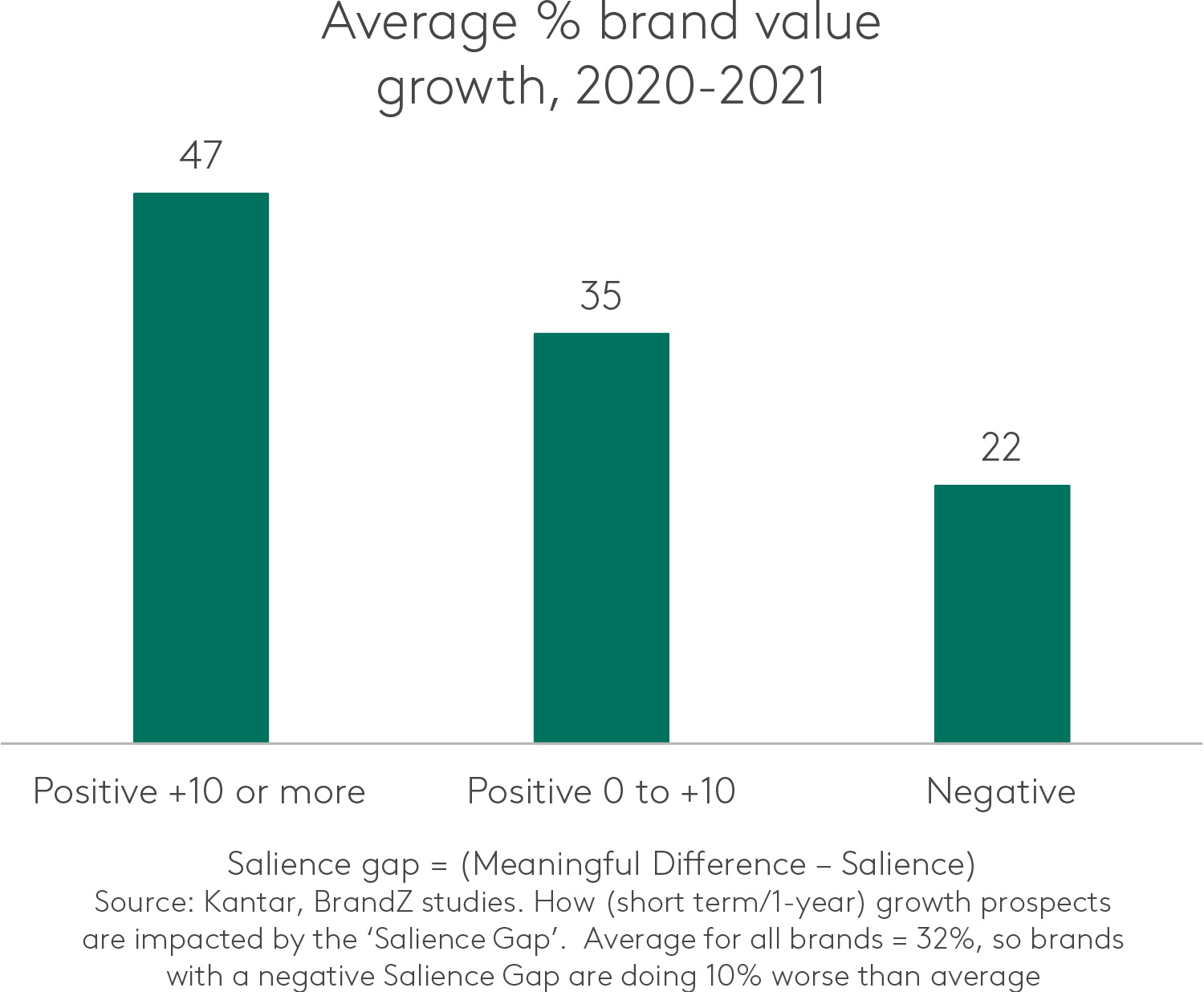

Flipped on its head, this last argument further supports the truth: our studies can prove that declining brands have over-invested in salience alone and have neglected nudging their meaningfully different brand associations. Kodak, Blackberry, Nokia, Toys R Us and IBM are some of the brands that were flying high until they weren’t. Although decoding their demise is a complex and nuanced exercise, what they all had in common is a strong heritage and high levels of salience. They still vanished though as fame alone is not sufficient for growth

-

Talking percentages, a Kantar analysis of growth brands globally found only one quarter were able to grow from salience alone. The other three quarters grew from working on that reciprocate relationship with consumers that leads to repeat purchasing – a focus on ‘meaningful difference’ (J Walker Smith’s The Courage to Grow White Paper).

-

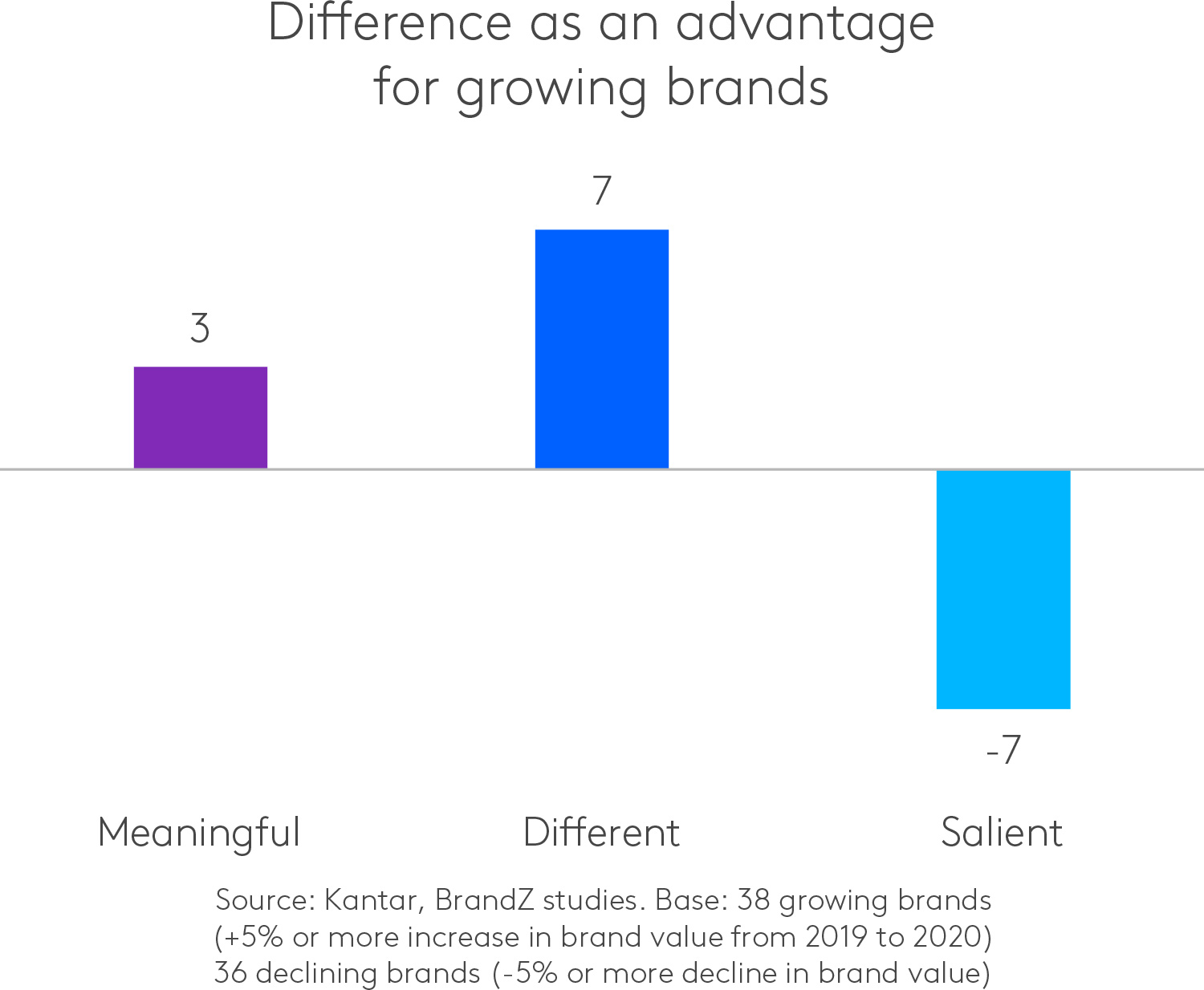

The eccentric ‘differentiate or die’ mantra holds great truths. Over and over again, the biggest discriminator of brand growth and resilience in difficult times is proven to be difference. The graph below vividly illustrates difference as the definitive advantage for growing brands.

A brand’s perception as meaningful different is linked directly to profit too. Whether consumers are driven by brand (choose a brand first, then look for the best price) or are driven by price (can’t resist a good bargain), they are willing to pay more for those brands they single out as meaningfully different. A striking 37% more in the case of brand-driven consumers, a respectable 14% more for those who are price-driven.

Diesel's CEO Massimo Piombini summarises the sentiment artistically: “When you think a brand is expensive, it’s because your perception of the brand is wrong. When your perception is right, there is no price resistance. Suddenly paying €250 for a pair of jeans, you think you got a good deal.”

How much of your sales are driven by your brand equity? And how can you influence them?

You’ve built your strategy and you are about to proudly activate it. Small changes in your brand positioning can have an impact on your brand equity or, in measurement terms, those equity measures of your Brand Power that are indicative of your sales.

You can now have a play, puppeteer the image associations that make your brand meaningful, different, salient and test the impact of different scenarios on your equity and sales. This simulator helps you optimise your investments for better returns.

Getting brand equity wrong. It can happen to the best of us

Even top brands can lose sight of their brand equity at times when short-term goals become a priority. Adidas’ senior Director of Global Media, Simon Peel, has been open about the company’s journey to move from efficiency to effectiveness. Giving into the pressures to deliver in the short-term, Adidas over-invested in their digital advertising and their interim sales at the expense of building their long-term brand equity. “We were trying to grow sales very quickly” Simon says, “we were focusing on the wrong metrics, the short-term, because we have fiduciary responsibility to shareholders”.

Adidas’ rectification action plan encompassed a deeper emotional connection with consumers, a consistent measurement system across the business, in essence, a greater focus on long-term growth.

Binet’s and Field’s latest research on their 60/40 rule – which is a universal lighthouse on how much to invest in the short and the long term - shows that sales activation is becoming much more efficient. And as this happens, Binet says, “activation requires less budget and so, almost counter-intuitively, the optimum split is shifting away from sales activation towards brand building”. To put it simply, Binet continues “in a digital world, emotional brand building is more important than it’s ever been”.

It’s a weakening emotional connection with consumers that’s the culprit for the long-term decline of the UK brands (BrandZ UK Top 75). Their scores for ‘meaningful difference’ – the impressions they leave in people’s heads but also in people’s ‘gut’ – have been falling over the last eight years.

In the UK, our plan of action is concrete, and we are partnering with the Marketing Society to bring it to life. We know very well that brand building is dependent on developing an emotional connection with consumers. Also, that this is a prerequisite for mastering the long/short term momentum and achieving solid gradual brand growth. Our 4-pillar plan is designed to equip thirsty-for-growth brands in the UK and all around the world to take transformational action.

Brand equity: a shift in the consumers’ mind, but equally, in the marketers’ approach. Some home truths to sum up:

- ‘Brand’ has never been more important. The stronger the brand, the more superior the shareholder returns, the greater its resilience in times of crisis – a proven fact, accentuated by the pandemic.

- ROI rocks, we are all in agreement; it shows you what works and what doesn’t. But its powers dissipate beyond the short term.

- Successful brand building starts with the realisation that we are in it for the long run. A eureka moment that brand building is not a cost, it’s an investment.

- Measurement is not (or rather shouldn’t be) a vanity project; it’s a meaningful input into the decision-making process, an input that stimulates interaction and exercises influence in the boardroom.

- Measuring and tracking progress is only worthwhile if consistency lies underneath. Building or tweaking one’s strategy comes first; the hunt for the world’s best brand tracker comes later.

- Trading on fame only can leave a brand in an exposed position, as an eroding connection with consumers leads to a brand’s eroding value.

It feels to me that the old cliché is unbecoming: “good things” DON’T “come to those who wait”. Good things come to those who work systematically towards acquiring them. Securing a sale and growing your market share are not the result of one action, rather a series of actions that take meticulous planning. Using the right brand guidance system to measure and build your brand equity is part of the process and we would be delighted to talk to you about it when you feel the time is right for you.

Look out for the next article in our series on brand equity – how to build your brand equity. And if you missed it, read our first article ‘What is brand equity?’ here.