Take-home grocery sales in Ireland increased by 10.8% in the four weeks to 11 June 2023 as the average price per pack increased 14.1%, according to our latest data. Shoppers returned to store more often during June (+9.2%) compared to last year, making an average of two additional trips, down slightly compared to May.

While value sales are up this month, grocery price inflation remains the reason behind this. Grocery inflation rose by 15.8% in the 12 weeks to 11 June 2023, which is down on last month’s level of 16.5% and is the lowest level of inflation seen so far this year.

This latest drop in grocery price inflation will be very welcome news for consumers, although it is too soon to say if this is the ceiling as inflation rates are still much higher than we have previously seen.

Over the 12 weeks to 11 June 2023, take-home grocery sales increased by 11%, with consumers turning to shopping little and often to help manage household budgets. The percentage of packs sold on promotion also increased to 25.8% compared to 24.7% last year, showing shoppers are carefully choosing promotional items to help them to make ends meet.

Consumers fire up the barbecues on longer warmer days

Irish consumers enjoyed longer warmer days during the last four weeks and took the opportunity to crack out the barbecues. As a result, they spent an additional €2.9m on beer and lager, €1.9m on chilled burgers and grills, and €1.2m on fresh sausages.

With the cost-of-living crisis bringing change to traditional shopping and eating behaviours, people are also thinking more about what they eat and how they cook at home. As shoppers look for easier meals with less waste, sales of total chilled ready meals shot up by 20% with shoppers spending an additional €2.9m year-on-year.

Consumers opt for money-saving own label

Over the 12 weeks to 11 June 2023, the growth in sales of own label (15%) was almost double that of brands (7.8%) as shoppers look for ways to save money. Value own label saw the strongest growth, up 28.9% year-on-year with shoppers spending €15.7m more on these ranges.

Online sales remained strong over the 12-week period, up 2.2% with shoppers spending an additional €3.5m on the platform year-on-year. New shoppers boosted overall growth by €6m as nearly 17% of Irish households purchased online.

Irish retailer performance update

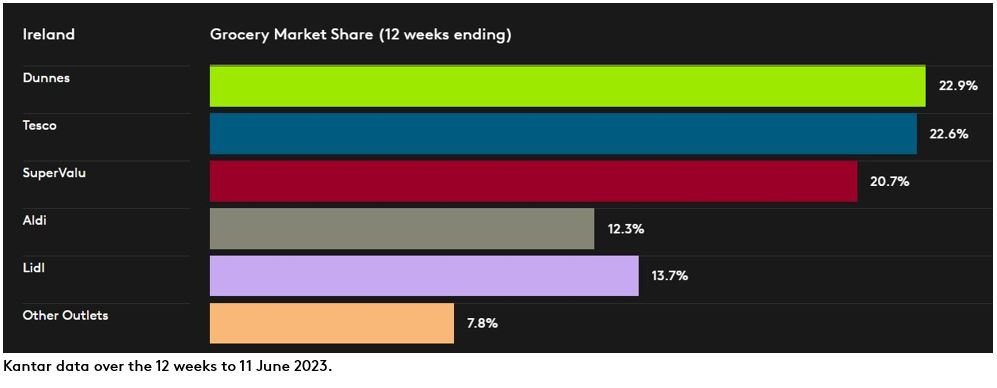

Dunnes, Tesco and Lidl all grew sales ahead of the total market in terms of value this month, with the gap in market share beginning to close between the top two retailers.

Dunnes continues to hold the highest share amongst all retailers at 22.9% with growth of 15% year-on-year. This growth stems from shoppers returning to store more often, up 2.1% year-on-year along with new shopper arrivals up 3.3ppts year-on-year.

Tesco holds 22.6% of the market with 13.5% growth year-on-year. Tesco has the strongest frequency growth amongst all retailers, up 17.7% year-on-year, contributing an additional €103.6m to its overall performance.

SuperValu holds 20.7% of the market and growth of 6%. SuperValu shoppers make the most trips in store compared to all retailers, an average of 24 trips, up 15.3% year-on-year.

Lidl hit a record new share of 13.7% with growth of 15.5% year on year. More frequent trips and new shoppers contributed an additional €45.2m to the retailer’s overall performance. Aldi holds 12.3% with growth of 10.3% year-on-year. A boost in new shoppers and more frequent trips contributed an additional €49m to overall performance.