Take-home sales at the grocers increased by 2.2% over the four weeks to 7 July 2024, according to our latest data. Running up to the quarter-final round of the Men’s UEFA European Football Championship, the latest figures show impact the tournament has made on the sector.

England’s hopes might have been dashed on Sunday, but there was still some cause for celebration in the grocery industry. Football fans drove beer sales up by an average of 13% on the days that the England men’s team played, compared with the same day during the previous week.* Sales of crisps and snacks also got a boost, up by 5% compared with the month before. With many matches played on “school nights”, though, some Britons chose moderation. Spending on no and low-alcohol beer soared by 38% on matchdays.

Temperatures fail to rise but inflation falls

While the calendar of summer events is now well underway, shoppers are continuing to reach for items more typically associated with cooler weather. We’re still waiting for the great British summer to break through the clouds, and we’re seeing the effects of that in our shopping baskets. Over the past three months, sales of cold and flu treatments jumped by 35%, while sun cream dipped by 10% compared with last year, when we were enjoying the warmest June on record. Some shoppers aren’t letting the disappointing weather dull their glow, however, pushing up sales of artificial tan by 16%.

Grocery price inflation fell again this month to 1.6% – its lowest figure since September 2021. The drop coincided with the fastest rise in monthly footfall so far in 2024. Britons made 2% more trips to the supermarket this period than they did one year ago. As pressure on pockets eased, sales of branded products increased by 3.6%, outpacing own-label items at 2.7%.

Evolution of consumer habits since last Labour government

Amid signs that consumer confidence is improving, retailers will be turning their attention to the King’s Speech on Wednesday to see what the newly elected government’s legislative agenda holds for the grocery sector. The retail landscape looks very different from 2010 when the last Labour government was in power – and so do our shopping trolleys. As diets have evolved, sales of popcorn, peanut butter and chilled vegetarian products, such as sausages and grills, have more than trebled. We’re also more likely to have premium ground and bean coffee in our cups now.

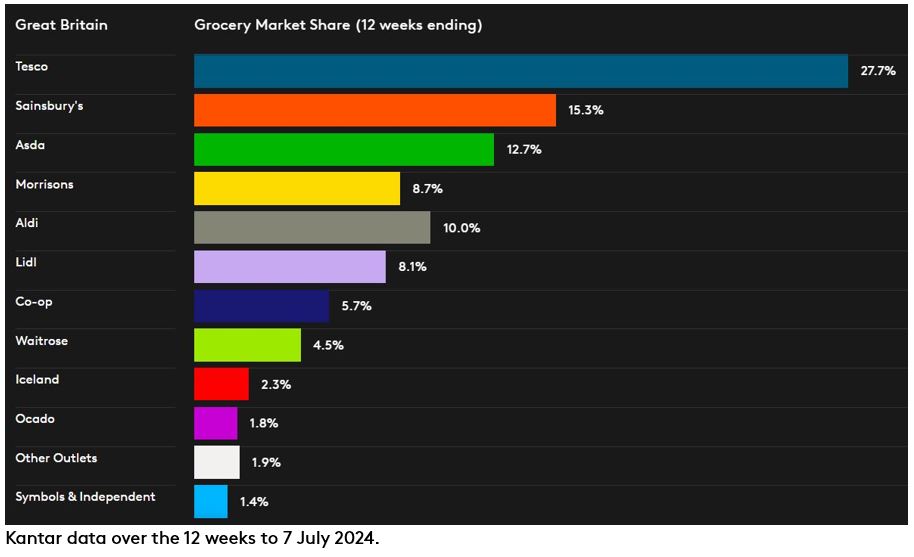

Ocado was the fastest growing grocer for the fifth month in a row, with sales up by 10.7% over the 12 weeks to 7 July. The online-only retailer now holds 1.8% of the market, up 0.1 percentage points compared with the same period last year.

Lidl saw a 7.8% jump in sales, bringing its share of the market to 8.1%. Waitrose gained share for the first time since January 2022, achieving a 0.1 percentage point rise to 4.5% as spending at the retailer increased by 3.3%.

Britain’s largest grocer Tesco achieved its biggest share gain since November 2021, taking 27.7% of the market – a 0.7 percentage point increase versus last year. Sainsbury’s boosted sales by 4.7% over the latest 12 weeks, bringing its share to 15.3% up from 14.9%. Morrisons accounts for 8.7% of the market, while Asda holds a 12.7% share. Aldi’s market share now stands at 10%.

Co-op holds a 5.7% share, and Iceland maintains its 2.3% portion of the market, nudging up its sales by 4.1%.

*Average increase in beer sales on 16 June, 20 June, 25 June, 30 June, and 6 July versus the same day one week previous.