The answer is, surprisingly a lot when it comes to consumer decision-making. Intuitive ‘type 1’ processing and the more rational ‘type 2’ processing both play into the new decisions and re-evaluations that consumers are carrying out every day during the pandemic. Combining this understanding with Kantar COVID-19 Barometer findings marketers can better understand current and likely consumer behaviour, and more effectively sway opinion and shift behaviour in favour of their brands.

Kantar’s proprietary decision-making model recognises that humans don’t make decisions in a vacuum, it accounts for motivational, situational and cognitive factors to provide a fuller perspective. This makes it a powerful tool to better understand how COVID-19 circumstances are impacting consumer decision-making.

For example, new findings from the COVID-19 Barometer show that overall levels of concern for the pandemic remain high around the world, although they are abating with time. Uncertainty persists, and 93% of people are worried about the potential for the virus to return in a few months. People are feeling insecure, and this will impact how they process information and how they respond.

Even as governments in many countries relax lockdown laws and commercial businesses reopen, people remain at home, with 66% saying that they will continue to avoid busy places. Not reassured by mandated hygiene and social distancing measures, 50% of people want regular testing for all, and many want it to be mandatory to wear face masks. Retailers and brands need to respond to these concerns with an understanding of the behavioural sciences. Let us explain.

Kantar’s decision-making model

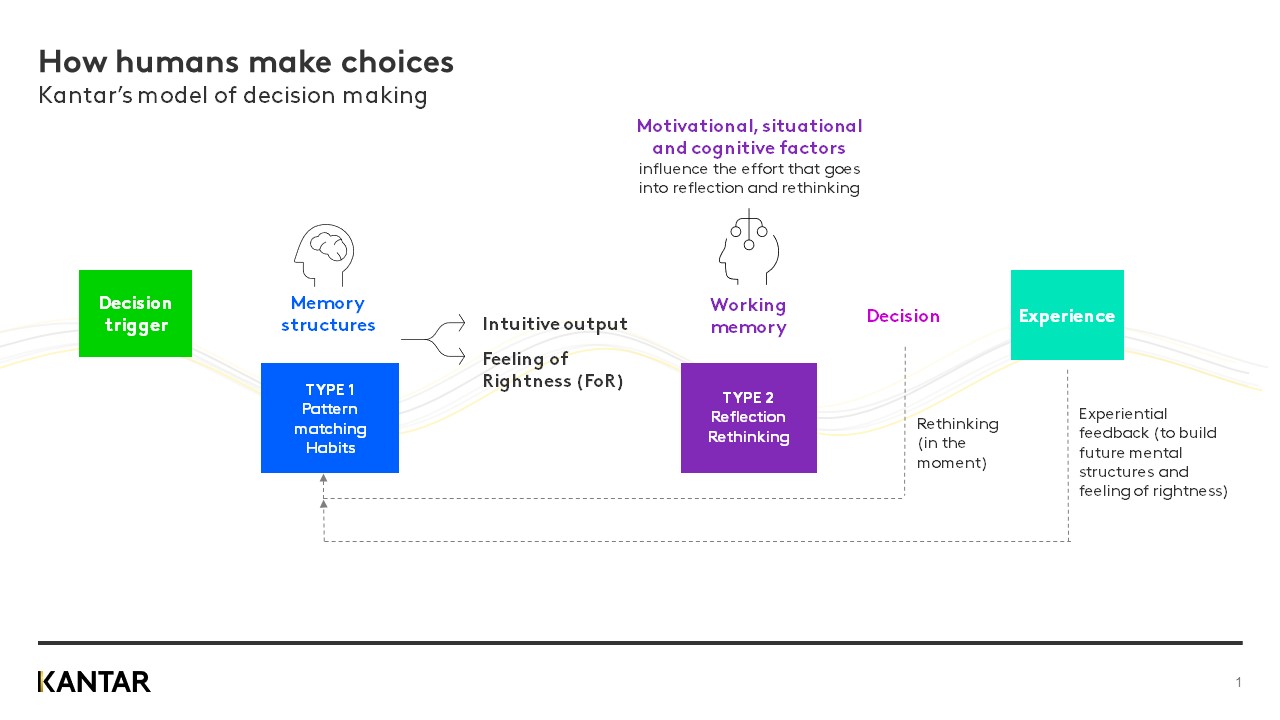

Customer-brand experiences create emotions and memories that influence future choices. Kantar’s decision-making model (see chart below) is premised on the idea that all decisions undergo type 1 and type 2 processing. Type 1 processing is involuntary, intuitive and often non-conscious, so we are not always aware of it happening. Our model is built on scientific evidence for the role of ‘Feeling of Rightness’ (FoR), which occurs in type 1 processing. FoR is an intuitive, mental calibration of how ‘good’ we feel that type 1 solution is. It’s important because it determines the amount of subsequent processing.

When FoR is strong, the brain does little additional processing and ‘goes’ with the decision that type 1 processing has proposed. We go on with our day, spared of the effortful task of having had to deeply reflect on yet another decision. This is what happens when consumers encounter a brand at shelf for which they have strong positive mental associations, such that they essentially just grab the product and go.

When FoR is weak, the brain will leverage greater type 2 processing resources. Consideration, rationality and logic are marshalled. In a sense, this is when the non-conscious brain says to itself, ‘I’m not so sure, maybe we should think about this.’ What will happen is that you will get reflection or justification of the default intuition or you will get rethinking and potentially arrive at an alternative decision – or perhaps not.

Brands can influence both type 1 and type 2 processing – and the interplay between them. They can influence type 1 processing by building positive brand associations through customer experiences, including communications. They can influence type 2 processing by giving consumers rational reasons for selection when they know customers have the resources and circumstances to reflect on them.

It is critical to understand that COVID-19 circumstances are providing a new playing ground for earning preference, because the situational and motivational factors are changing. For example, situational factors such as shortages and tighter household budgets, have influenced consumer decision-making. Motivational factors, such as a desire for control or wanting to provide for one’s family have impacted as well.

Provide reassurances of safety and security

How does this all add up, right now?

People are feeling insecure. Wave 5 of the COVID-19 Barometer finds that 66% will continue to be very conscious about distancing and avoiding busy places. With health and safety still a concern, just 37% expect to return to their typical consumer behaviour within 2 or 3 months time. So, retailers and brands will need to reassure consumers that shopping environments and products are safe, if they expect people to choose them. Trusted brands have the advantage here. They have already built up those positive mental associations, and FoR is likely to be higher when it comes to a decision involving that brand. Although, with 74% of viewers saying that they happy with the volume of advertising, all smart brands will continue to advertise now in order to continue to modify and build positive brand associations that influence type 1 processing.

Brands will also need to respond in ways that support type 2 processing in their favour. With 84% of audiences describing COVID-19-related advertising as positive, using words like ‘informative’, ‘helpful’ and ‘reassuring’, there is a clear opportunity for brands to rationally reduce personal health and safety concerns. It’s not surprising that wave 5 of the COVID-19 Barometer finds that consumers are currently looking to brands for trustworthiness and leadership.

Prove your worth to the ‘recession mindset’ to spur growth

Influencing consumer decision-making with an understanding the interplay between of type 1 and type 2 processing is all the more important now as economic pressure grows and consumer switching behaviour is in full swing. As the crisis progresses, more households are feeling the negative impacts; the percentage of those with financial concerns continues to rise to 56% (previous high of 53%).

Sensibly, the majority of consumers (65%) are increasingly turning their attention to prices, and 53% are looking for products on sale. Providing customers with lower prices, a rational reason for choice, taps into type 2 processing. Equally brands that harbour strong value-for-money perceptions have the potential to garner favour, via type 1 processing.

Brands can create competitive advantage during the pandemic and in the future by building intuitive brand associations for better FoR and developing rational drivers of choice. Using the Kantar decision-making model and findings from COVID-19 Barometer, retail brands have the opportunity to influence consumer choices with interventions that work with the brain’s natural decision-making mechanisms.