Category maturity is a hidden factor behind the growth trajectories of many large brands. It’s also behind the recent, cross-category trend of top brands expanding into new spheres of business.

Consider this scenario: A big brand finds itself in an immature, high-growth category (something like hard seltzers 10 years ago, or AI business services today). In this case, the dual task of our brand would be to accelerate the Meaningful perceptions of the total category, as well as of its own individual brand’s equity. Doing so can yield turbocharged growth.

But then, consider the common sequel to such a situation. Too often, growth slows down as our brand’s once-new category reaches maturity, leading the brand to look for new spaces to stretch into. You can see examples of this ‘Find New Spaces’ imperative playing out today in all sorts of categories, from pet care and mobility to condiments.

Sounds like a no-brainer, right? But the truth is that accelerating the growth of one’s current category, or expanding into new spaces, are both tasks that can be best carried out by brands that already enjoy positions of relative strength. So, if your brand is currently struggling to be seen as Meaningfully Different, then you may need to ‘shore up your core’ before expanding into new spaces.

But let’s assume that your core brand is strong, and that your category is mature. In that case, yes you need to move into new growth spaces, and fast. No matter how urgent the need for change, this ‘Find New Spaces’ process should always start with challenging yourself on the definition of the business you are in – which in turn should draw on an understanding of the underlying motivations and usage occasions of your consumers.

Often, there is a difference between the category a brand says it operates in and the category a brand is really competing in when it comes to securing a share of consumers’ paycheques. So, you need to be ready, willing and able to challenge yourself on your actual category positioning.

The issue is that most category definitions are product or manufacturing based. As such, brands can fail to see and understand the (emerging) needs and occasions they could serve. And they are unaware of the alternate solutions people are already pursuing to satisfy their needs today.

In the messy real world, your true competition isn’t only the other brands and products that are ranked beside you in tracking or at point of sale. The reality is more expansive than that:

• Painkillers compete with heat treatments and massages

• Wine competes with tea and biscuits

• Subscription Video on Demand (SVOD) services compete with books and trips to the cinema.

The reason for this is that people relatively seldom make very linear, rational, cognitively engaged choices. Their decisions are often framed less by a question like, “Which of these narrowly defined category offerings should I go for?” And more by a question like, “What do I need now to make me feel better?”

So, the way to Find New Spaces is to take a step back from the category and instead consider more broadly (and also more closely) how people live. Consider the fundamental needs that drive people’s choices. This can provide the real advantage of being able to do something first. For example:

• Learning about a new city meant paying for professional guides or guidebooks – until Airbnb Experiences came along.

• Crisps were cheap, and mostly meant for kids – until Walkers Sensations.

• Interior design was down to specialists – until IKEA launched its home design solutions offering. These and all other such new space opportunities always seem forehead-slappingly obvious with the benefit of hindsight. Obviously though, the real trick is being able to see them in advance.

Converting new space opportunities into growth can sometimes be as simple as providing better communication (to help people see your offering as being relevant to a new context, consider the rising popularity of Baileys Irish Cream among bakers). Or it could mean extending distribution (to make the brand more present in that emerging context). On other occasions, innovation is needed to address emerging opportunities for the brand.

Mercado Libre is a Latin American ecommerce platform that was founded in 1999 and had grown by 2006 to become Latin America’s largest trading platform. It achieved this initial growth by following a clear path of finding new geographical spaces. Today, it is active in 18 countries with Argentina, Mexico and Brazil (where it’s known as Mercado Livre) as its biggest markets. It’s a great example of a brand reaping the rewards from being an early pioneer.

Since 2012, however, Mercado Libre has experienced greater competition in its core ecommerce business, most notably from Amazon. In response, Mercado Libre has surfaced new spaces to grow into by extending its range of categories and products sold. But of course, its competitors have made bold moves too. Singaporean brand Shopee entered the Brazilian market in 2020 and now offers a wide range of low-priced products (similar to what consumers elsewhere might find on a platform like Alibaba). It has since become the most downloaded, most used shopping app in Brazil. In response, Amazon has also reorganised this decade around offering more convenience and value for money.

This disruption to Mercado Libre’s core retail business has made its third type of new spaces expansion – into services – all the more crucial. First founded in 2003, the brand’s Mercado Pago platform is a payment system that now stands as a full-service fintech player for B2C and B2B clients. Today, Mercado Pago contributes to half of the brand’s revenue.

Going forward, Mercado Libre’s main growth strategies all involve new ways to increase the frequency of usage, or they serve to stretch the brand into new categories. For example, it’s working on ways to expand use of the Mercado Pago service on other retail platforms. In the future, the brand may also offer more in the way of entertainment streaming services.

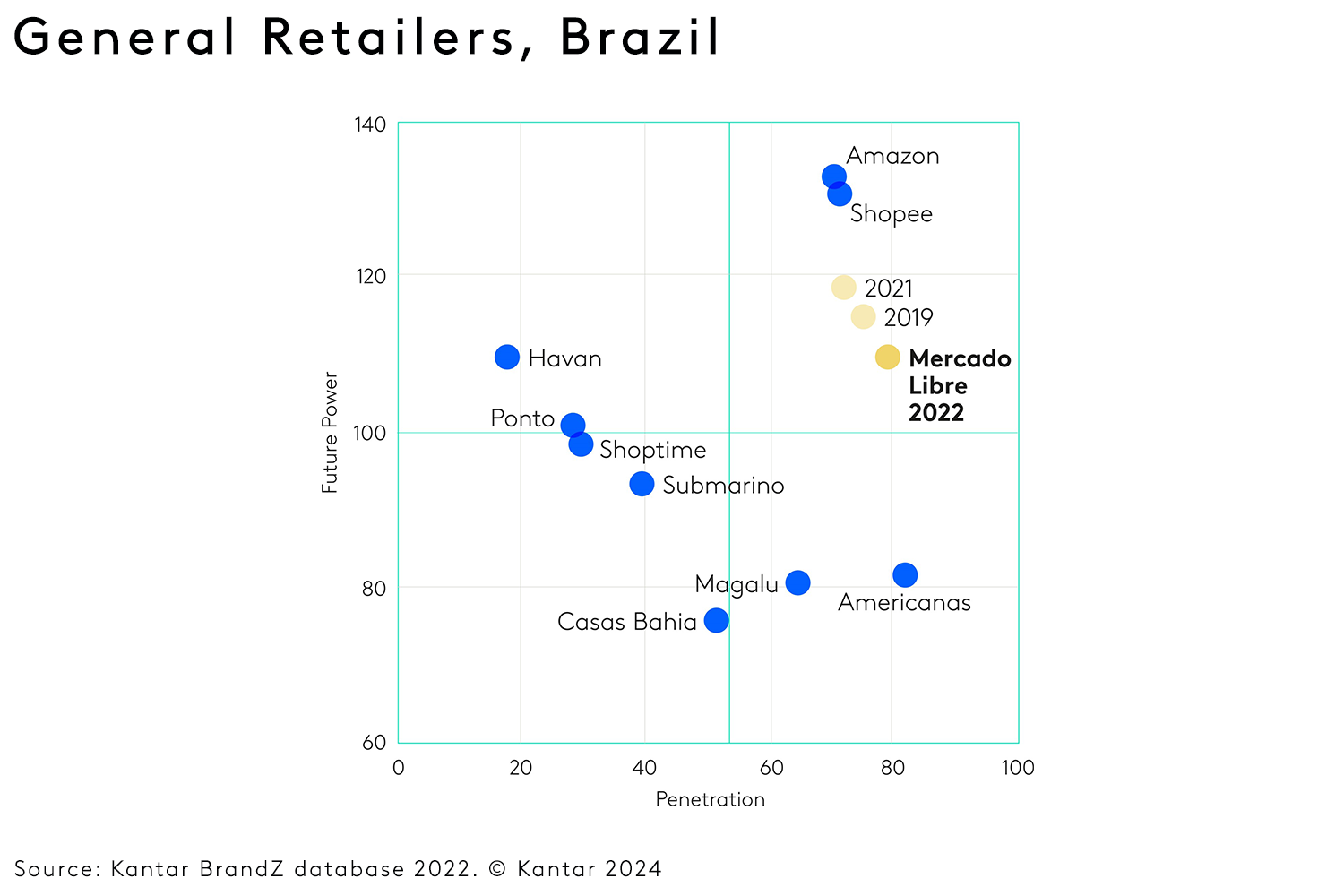

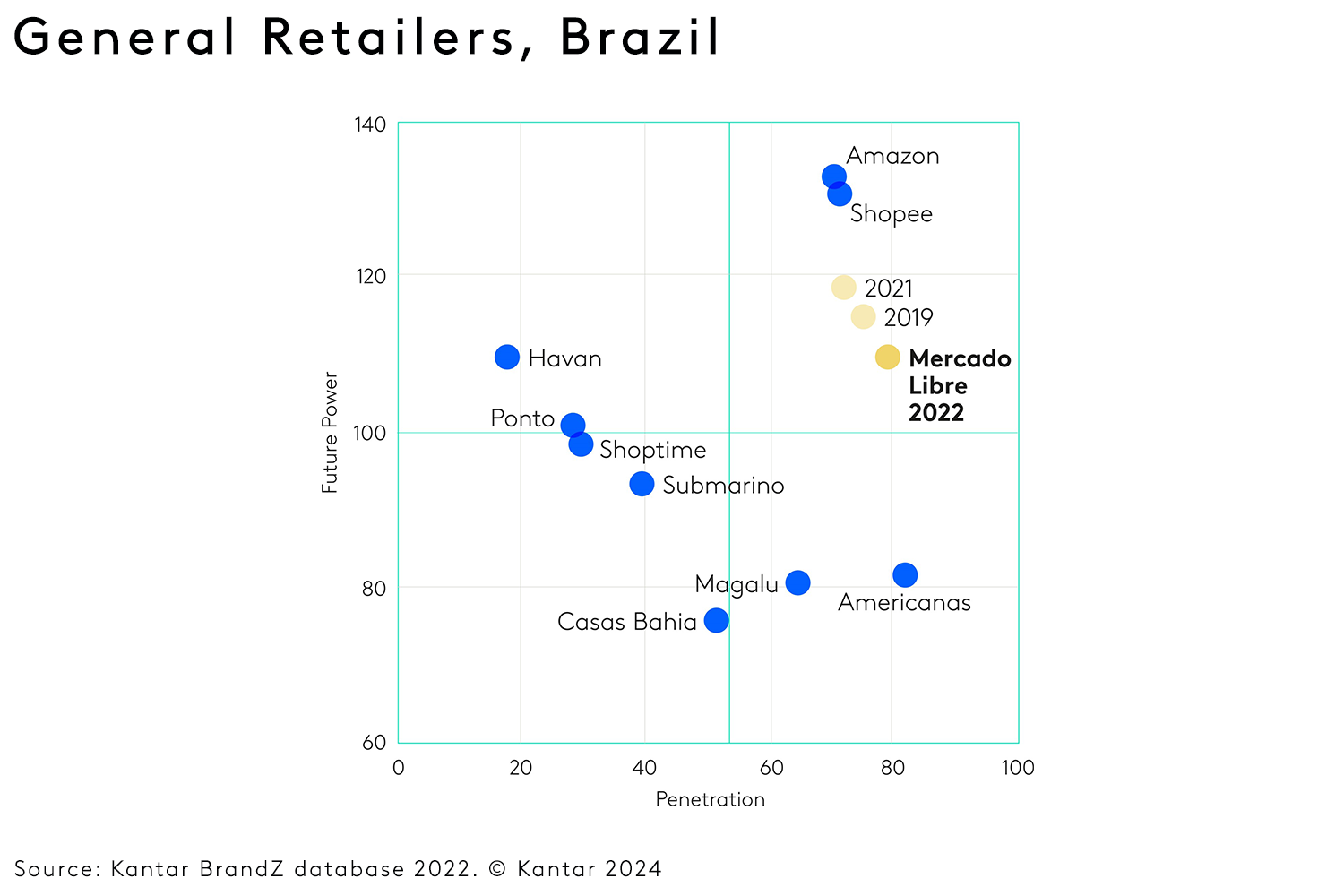

A potential threat to these ventures has emerged, however, in the form of downward pressure on the brand’s Future Power, as seen in this chart.

To grow, brands first need to have a strong foundation in their current core categories, a foundation that ideally involves the kind of repeat business dynamics that Future Power measures. In other words, even whilst prioritising new categories, Mercado Libre needs to bolster its experience credentials among current customers, and especially among the audiences that Shopee and Amazon now cater to as well. The relaunch of Mercado Libre’s loyalty programme, Meli, is just a first step in this bid to ‘secure the core’ whilst also finding new spaces, a kind of two-step strategic dance that has become a hallmark of modern brand-building.

Consider this scenario: A big brand finds itself in an immature, high-growth category (something like hard seltzers 10 years ago, or AI business services today). In this case, the dual task of our brand would be to accelerate the Meaningful perceptions of the total category, as well as of its own individual brand’s equity. Doing so can yield turbocharged growth.

But then, consider the common sequel to such a situation. Too often, growth slows down as our brand’s once-new category reaches maturity, leading the brand to look for new spaces to stretch into. You can see examples of this ‘Find New Spaces’ imperative playing out today in all sorts of categories, from pet care and mobility to condiments.

Sounds like a no-brainer, right? But the truth is that accelerating the growth of one’s current category, or expanding into new spaces, are both tasks that can be best carried out by brands that already enjoy positions of relative strength. So, if your brand is currently struggling to be seen as Meaningfully Different, then you may need to ‘shore up your core’ before expanding into new spaces.

But let’s assume that your core brand is strong, and that your category is mature. In that case, yes you need to move into new growth spaces, and fast. No matter how urgent the need for change, this ‘Find New Spaces’ process should always start with challenging yourself on the definition of the business you are in – which in turn should draw on an understanding of the underlying motivations and usage occasions of your consumers.

Often, there is a difference between the category a brand says it operates in and the category a brand is really competing in when it comes to securing a share of consumers’ paycheques. So, you need to be ready, willing and able to challenge yourself on your actual category positioning.

The issue is that most category definitions are product or manufacturing based. As such, brands can fail to see and understand the (emerging) needs and occasions they could serve. And they are unaware of the alternate solutions people are already pursuing to satisfy their needs today.

In the messy real world, your true competition isn’t only the other brands and products that are ranked beside you in tracking or at point of sale. The reality is more expansive than that:

• Painkillers compete with heat treatments and massages

• Wine competes with tea and biscuits

• Subscription Video on Demand (SVOD) services compete with books and trips to the cinema.

The reason for this is that people relatively seldom make very linear, rational, cognitively engaged choices. Their decisions are often framed less by a question like, “Which of these narrowly defined category offerings should I go for?” And more by a question like, “What do I need now to make me feel better?”

So, the way to Find New Spaces is to take a step back from the category and instead consider more broadly (and also more closely) how people live. Consider the fundamental needs that drive people’s choices. This can provide the real advantage of being able to do something first. For example:

• Learning about a new city meant paying for professional guides or guidebooks – until Airbnb Experiences came along.

• Crisps were cheap, and mostly meant for kids – until Walkers Sensations.

• Interior design was down to specialists – until IKEA launched its home design solutions offering. These and all other such new space opportunities always seem forehead-slappingly obvious with the benefit of hindsight. Obviously though, the real trick is being able to see them in advance.

Converting new space opportunities into growth can sometimes be as simple as providing better communication (to help people see your offering as being relevant to a new context, consider the rising popularity of Baileys Irish Cream among bakers). Or it could mean extending distribution (to make the brand more present in that emerging context). On other occasions, innovation is needed to address emerging opportunities for the brand.

Case Study: New Spaces in Action

To further illustrate the multiple ways brands can think about ‘new spaces’, let’s look at Mercado Libre, one of the fastest risers in the latest Kantar BrandZ Global Top 100.Mercado Libre is a Latin American ecommerce platform that was founded in 1999 and had grown by 2006 to become Latin America’s largest trading platform. It achieved this initial growth by following a clear path of finding new geographical spaces. Today, it is active in 18 countries with Argentina, Mexico and Brazil (where it’s known as Mercado Livre) as its biggest markets. It’s a great example of a brand reaping the rewards from being an early pioneer.

Since 2012, however, Mercado Libre has experienced greater competition in its core ecommerce business, most notably from Amazon. In response, Mercado Libre has surfaced new spaces to grow into by extending its range of categories and products sold. But of course, its competitors have made bold moves too. Singaporean brand Shopee entered the Brazilian market in 2020 and now offers a wide range of low-priced products (similar to what consumers elsewhere might find on a platform like Alibaba). It has since become the most downloaded, most used shopping app in Brazil. In response, Amazon has also reorganised this decade around offering more convenience and value for money.

This disruption to Mercado Libre’s core retail business has made its third type of new spaces expansion – into services – all the more crucial. First founded in 2003, the brand’s Mercado Pago platform is a payment system that now stands as a full-service fintech player for B2C and B2B clients. Today, Mercado Pago contributes to half of the brand’s revenue.

Going forward, Mercado Libre’s main growth strategies all involve new ways to increase the frequency of usage, or they serve to stretch the brand into new categories. For example, it’s working on ways to expand use of the Mercado Pago service on other retail platforms. In the future, the brand may also offer more in the way of entertainment streaming services.

A potential threat to these ventures has emerged, however, in the form of downward pressure on the brand’s Future Power, as seen in this chart.

To grow, brands first need to have a strong foundation in their current core categories, a foundation that ideally involves the kind of repeat business dynamics that Future Power measures. In other words, even whilst prioritising new categories, Mercado Libre needs to bolster its experience credentials among current customers, and especially among the audiences that Shopee and Amazon now cater to as well. The relaunch of Mercado Libre’s loyalty programme, Meli, is just a first step in this bid to ‘secure the core’ whilst also finding new spaces, a kind of two-step strategic dance that has become a hallmark of modern brand-building.