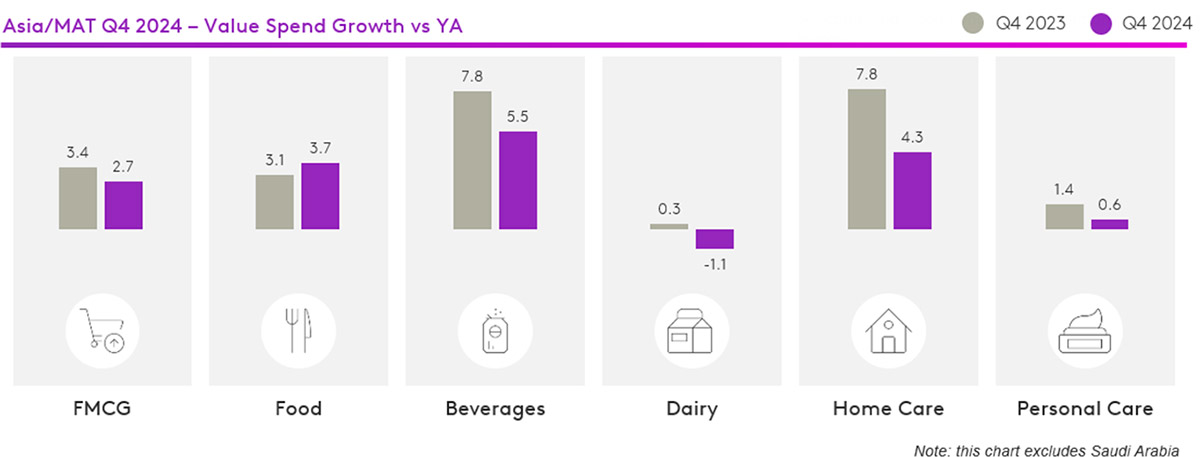

As 2024 came to a close, the FMCG sector in Asia maintained its resilience, growing in value by 2.7% in Q4. While the pace of expansion has become more moderate, this stability underscores the region’s ability to adapt to shifting market dynamics. West and South Asia experienced a slowdown from the high growth seen in 2023, which was driven by price fluctuations. Most sectors ended the year positively, with dairy the only category facing continued challenges.

North Asia: Lifestyle shifts fuel FMCG growth

North Asia’s FMCG market continued to grow steadily, with a value increase of 1.8% in Q4 of 2024, signalling resilience in the face of ongoing challenges. While the personal care and dairy sectors continue to struggle, other categories, such as beverages, have helped sustain overall performance.

The Chinese mainland’s FMCG market remained stable in 2024. The beverage category saw significant growth, but personal care continued to decline – however this slowed in the fourth quarter. The dairy category still faces considerable growth challenges.

The FMCG market in Korea has been growing steadily, with a 6.6% value increase at the year-end. This was driven by an expansion in consumers’ basket size. Meanwhile, the decline in frequency observed in Q3 continued.

Taiwanese shoppers appreciate the convenience and affordability of online shopping, keeping e-commerce on a strong growth trajectory (+15%). However, they also continue to enjoy the in-store shopping experience, with the performance of hypermarkets (+7%) and supermarkets (+5%) improving from stable to strong.

Southeast Asia: Signs of stabilisation

Southeast Asia’s FMCG market remained resilient in the final quarter of 2024, with growth of 4.6%. Despite the modest increase, with food being the only sector growing at a higher rate than last year, the region shows positive momentum. Indonesia and the Philippines led the way, both achieving growth rates above 5%.

Malaysian shoppers have been making fewer visits across various shopping channels, but are offsetting this by increasing their spend per trip. Foot traffic in minimarkets has continued to rise, driven by the appeal of consistently low prices and convenience. However, this seems to result in a lower growth in spend per trip compared to other channels.

In Indonesia, supermarkets are the main drivers of penetration growth, bringing in new shoppers to the modern trade channel. At the same time, e-commerce complements traditional retail by attracting additional shoppers and strengthening the shift toward omnichannel shopping.

While in Thailand, take-home FMCG is finally recovering following two years of decline, led mostly by an increase in basket size and frequency. However, shoppers are switching to smaller pack sizes to avoid spending too much.

Filipinos’ top channels – sari-sari stores and hyper/supermarkets – remained stable in Q4 of 2024. Smaller channels like direct sales, discounters and e-commerce have driven overall growth, indicating that shoppers’ behaviour is becoming more omni-channel in nature.

Vietnam recorded a stellar economic performance in 2024, with strong GDP growth of 7.09%, demonstrating resilience despite the economic impact of typhoon Yagi. Overall consumer confidence in economic prospects improved from 2023, but has not yet recovered to pre-COVID levels in 2019.

India: Inflation makes an impact

Overall, the impact of inflation on household FMCG consumption remains moderate. Volume sales grew by 4.6% in Q4 of 2024; however, the pace of growth is slower compared to the 8% seen in Q4 2023. In the urban region, volume growth in the food sector was hampered in the second half of 2024 by a notable surge in price inflation.

UAE: Shoppers adapt to the rising cost of living

As consumers grapple with rising living costs, they are trying to find ways to get more value – opting for a higher frequency of shopping trips, with smaller baskets. Spend within discounters is rising sharply, making a strategic approach essential for driving brand growth. Consumers from all socio-economic groups visited discounters in 2024.

Saudi Arabia: Prices soften post-Ramadan

Despite an expanding economy and relatively low inflation, Saudi Arabia's FMCG sector is struggling to achieve healthy growth. The influx of white-collar expatriates has contributed to an overall increase in FMCG volume, yet this has not translated into robust value growth across categories. Shoppers remain price-conscious, with spending patterns shifting toward essential goods and promotion-driven purchases.

Asia Pulse Q4 2024, curated by Kantar Asia’s Worldpanel Division, provides an in-depth look into evolving market trends across the region. For further insights and tailored analysis, feel free to reach out to us.