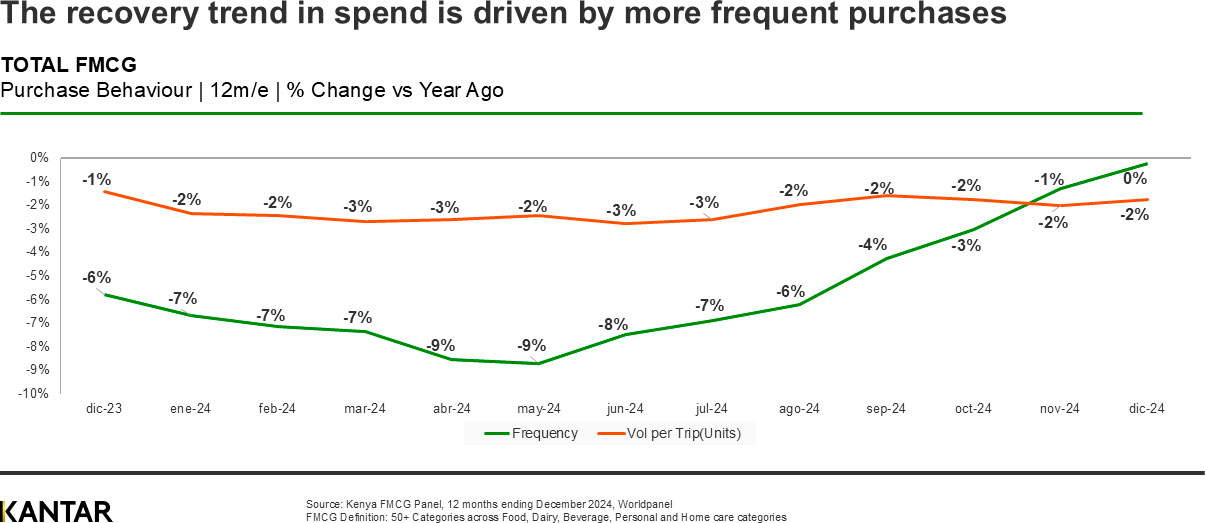

Household FMCG spending in Kenya recovered well during 2024, particularly in the second half of the year, driven by more frequent purchases.

A progressive decline in inflation led to an improved economic environment that has boosted consumers’ purchasing power and confidence. The resulting stability is crucial for FMCG manufacturers as it allows for more predictable costs and pricing strategies; ultimately benefiting both businesses and shoppers.

In short, Kenyans are once again willing to spend – and on a more regular basis. They still choose carefully where to spend their money, as they continue to navigate economic uncertainties. Frequency has been supported by increased promotional campaigns, which have encouraged cautious consumers to buy more often.

Most FMCG categories have experienced an upward trend in purchase frequency: a powerful lever for driving revenue and profitability. The dairy and personal care categories showed the most significant recovery – both with a year-on-year uplift in trips of 2% – highlighting the areas where consumer demand is rebounding most strongly.

Frequency within the resilient edible oils segment has continued to grow (+3%), while bread also performed remarkably well (+5%). These trends suggest that consumers are prioritising essential and staple items in their shopping baskets.

A broad based recovery across the market

Consumers in both urban and rural areas of Kenya are purchasing FMCG more frequently, with urban areas contributing a slightly higher share of spend (57%). Behaviour varies across different regions – with Nairobi exhibiting an improvement in purchase frequency, while the coastal areas experienced a decline.

These variations emphasise the importance of developing tailored strategies to effectively address unique regional dynamics and consumer behaviours.

Trends are positive across all socio-economic groups, with middle class households responsible for the largest share of total FMCG spend (60%).

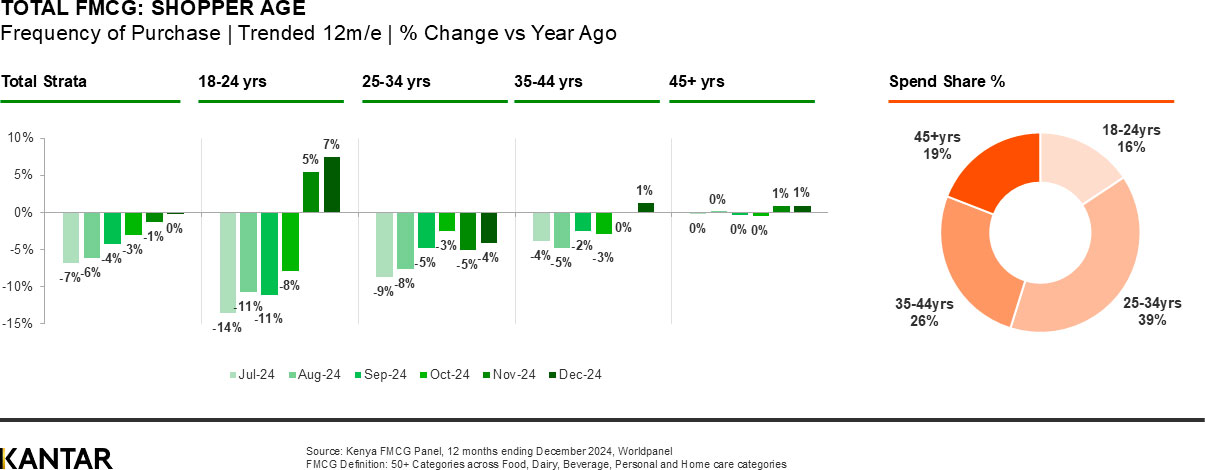

Younger consumers, those aged from 18-24 years, demonstrated the most significant recovery in terms of spend. However, brands must be sure to create inclusive and balanced marketing campaigns that also engage older consumers, especially the core 25-34 years demographic, to maximise reach and impact.

There are major growth opportunities in Kenya for FMCG brands that can leverage declining inflation and rising frequency of purchase to maintain and boost consumer spending.

In spite of the resurgence, manufacturers must continue to emphasise value-for-money products, highlight affordability in their marketing, and offer seasonal promotions. This strategy is essential for attracting and retaining cost-conscious consumers.

Contact our expert to access the full Kenya FMCG Monitor Q4 2024 deck.