Spanish households’ FMCG shopping preferences continue to evolve, with increasing importance placed on one-stop shopping, promotions, and the quality of private-label products. However, proximity and value for money remain the key factors influencing store choice.

Different models, shared success

Limited-assortment chains – which have reached a 37.7% share of total market value after gaining 0.6 percentage points year-on-year – continue to strengthen their strategy focused on private-label products. Meanwhile, regional supermarkets, which now hold an 18% share thanks to a 0.7 percentage point rise, rely on fresh produce and personalised service.

The success of regional supermarkets is further driven by their expansion into new geographic areas. Over the past five years, 68% of their new customers have come from outside their original regions, thanks to an adaptive product range they have tailored to local preferences.

Key players and their challenges

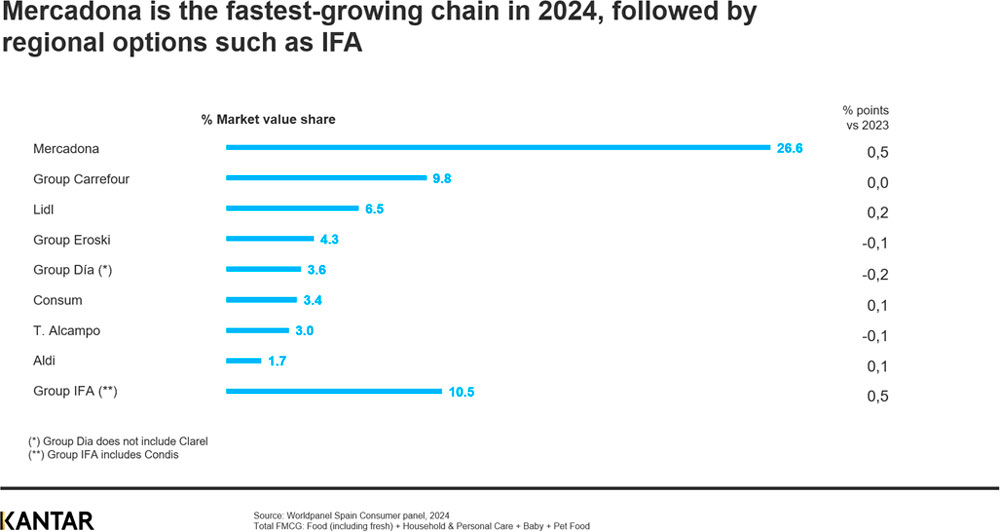

Mercadona, the leader in the limited-assortment segment, increased its share by 0.5 percentage points in 2024, with a particularly strong performance in the first half of the year and in regions with growth potential. Its challenge in 2025 will be maintaining this momentum as its customers increasingly turn to promotions in other chains.

Lidl has added 0.2 percentage points to its market share, consolidating its position as the fastest-growing chain since 2019 (+1.9 points). However, the rise of regional supermarkets poses a threat, as Lidl is the only major player losing share to this segment.

Dia has improved its performance following store renovations, and stands out for its popularity among senior households, which could become a competitive advantage. Aldi, now the fifth-largest chain by number of shoppers after doubling its customer base in the past decade, still needs to improve its category conversion rates.

Meanwhile, Carrefour has been impacted by a decline in hypermarket sales, losing share among families with children. However, its convenience store formats have helped stabilise its position, closing 2024 with a steady 9.8% market share.

Future outlook

Looking ahead to the rest of 2025, the key challenges are clear: limited-assortment chains must enhance their appeal to senior shoppers, while regional supermarkets need to encourage larger shopping baskets by identifying and meeting the specific needs of their customers in each market.

Contact our experts for additional information.