It’s no secret that the automotive industry is changing. With the electrification of cars, and the move to long-term leasing, the question of price, cost and value perception is something many futures buyers and car brand managers are struggling with.

The COVID-19 crisis, affecting people’s purchasing power and financial planning habits, has added uncertainty when it comes to buying decisions of high price items… such as cars.

How has this context changed the approach manufacturers and retailers should take to setting prices? How do they achieve an optimal price when there is so much to consider?

Pricing is complicated

Car manufacturers and dealers face a great deal of complexity in ensuring profitable deals (and lots of them). How many components must be factored in to set the “price” of a new car? 5, 10, 15, 20? It could be more. They include the Original List Price of the base model, version, engine type, power and displacement, equipment, connected features and subscriptions, financial schemes, insurance schemes, government incentives, regional incentives, maintenance contracts, manufacturer discounts, dealer promotions, the trade-in value…

The industry has traditionally carried out Price/Positioning analysis based on list prices (MSRP), the equipment (Price Adjustment) and any discounts (Promotion/Transaction Prices). But this is no longer sufficient to measure the true positioning, the competitiveness and even the real profitability of OEM’s carlines.

Changing approaches to car purchasing

We also need to consider how we give new car buyers confidence that they will be paying the right price for the right product – and how we purchase cars is also a complicated picture.

Since 2015, finance and private lease deals across the major European markets have increased significantly year by year, which changes the psychological value people attribute to a car. The “cost” is now counted in hundreds of Euros per month, and not in thousands of Euros cash. For instance, the Peugeot 2008 EV Active would cost around 38,000 Euros cash but just 530 Euros a month. Similarly, extra equipment, like heated front seats, are now considered as “a few Euros per month”, and not as hundreds upfront.

Finance drove transactions in 2019 for the EU5, with almost 70% of the deals closed financed (more than 80% in the UK). This is a figure that continues to grow.

The move towards monthly payments will continue, so it is critical to understand how car buyers compare monthly rates, where they perceive the value, and also how to monitor and manage pricing strategies and tactics in real time. Just talking about financial schemes there are multiple variable to consider: the list price to start with, the deposit, the percentage rate, the guaranteed resale value, the discounts and customer benefit included, and the inclusion (or not) of various public incentives.

The rise of electric cars

Electric or electrified cars, many of them launched in 2020, have a significantly higher price compared to their traditional internal combustion engine versions, especially in the mainstream mass market. For example, the price gap today between the ICE version of the Peugeot 2008 (24,000 Euros) and the EV (37,800 Euros before Eco Bonus, which can be up to 7,000 Euros) is around 14,000 Euros.

The cost of the electric vehicle (EV) technology will gradually come down, which will reduce the psychological price gap. However, nobody knows when exactly that price reduction will happen.

Additionally, while the resale value of a petrol/diesel car is rather well known by consumers, this is much less clear for those buying an EV. In other words, purchasing an electric car with cash carries a high risk for buyers. In 3 or 4 years’ time, the EV technology might be much better, more accessible, and – most important – much better understood by car buyers.

COVID-19 and car buying

The economic downturn and the uncertainties around the pandemic have increased consumers’ anxiety regarding financial stability and have pushed many to consider more cautious financial planning. It’s also created more willingness to choose flexible and easy-to-plan-for schemes for high value items, like cars.

In this context of this uncertainty, the inclusion of additional financial insurance services linked to the car purchase has become more and more relevant, allowing consumers to avoid financial turbulence along the life of the vehicle.

Taken together, these trends make monthly payments particularly attractive to consumers, and create an opportunity for car brands to manage their business with more visibility. They also create competitive challenges to be agile and reactive in the complex management of the pricing strategy.

Like any brand, automotive companies have to solve the basic equation of attracting more customers, while maximising the level of profitability of each vehicle sold.

First, we must understand the value that potential clients (no longer simply ‘new car buyers’) associate with various components of the car. Second, we must identify how monthly payment should be structured to maximise the attractive power of the package offered while maintaining good enough profitability levels.

1. Understand the value new car buyers associate with vehicle offers

Car buyers are not a homogenous group. We know that buying behaviour is driven by individual preferences, motivations and habits. Each car buyer’s perception of value is different – the value of technical specs and equipment, but also of a car brand itself.

For example, buyers don’t all value a more powerful engine the same; not all buyers are willing to pay the same amount for a glass roof. In addition, there are car buyers who are willing to pay more for a preferred brand name than for comparable offers by other car brands – even if product specifications are very similar.

Assessing the value of vehicle offers to car buyers is highly complex. Creating and capturing value is a matter of knowing what people value and what they are willing to pay for.

Unfortunately, new technology developments make this more and more challenging for marketers. But a deep understanding of car buyer behaviour and purchase patterns still offers big opportunities to develop prices and conditions that exploit existing price potentials.

This is especially true for electric vehicles because electric vehicle buyers don’t behave like traditional combustion engine buyers. For combustion engines, power was often highly relevant and more power justified higher prices. For electric engines, power is often less relevant; range and charging duration are now key. Comfort and safety features are still highly relevant for traditional vehicles but for new electric vehicles all kind of digitalization features become an important purchase driver.

So when you plan prices and conditions for vehicle offers, put yourself in car buyer’s shoes. For which vehicle brands are you willing to pay a premium price? How do you compare competing vehicle offers? What are the vehicle specs and features you are willing to pay for? How much difference in financial conditions is still acceptable for you? And do you expect for electrical vehicles a similar discount as for a traditional combustion engine vehicle?

2. Identify how monthly payments should be structured to maximise the attractiveness of the package offered, while maintaining profitability

Traditionally, trying to make a certain model as competitive as possible was quite straightforward: brands simply had to decide which marketing levers to pull (promotions and discounts). Nowadays, the situation has become tremendously complex, with plenty of new financial variables increasing or reducing both the competitivity and profitability of the same car (normally in opposite directions).

In this new marketplace, where the finance proposition has become a key selling point, it is no longer enough to dress your product portfolio with an adequate promotional strategy. You must also consider the finance levers (deposits, APRs, duration of the deal…) as individual drivers that could themselves make a model as attractive as another with a ‘better’ traditional price positioning approach (low list price or high discounts).

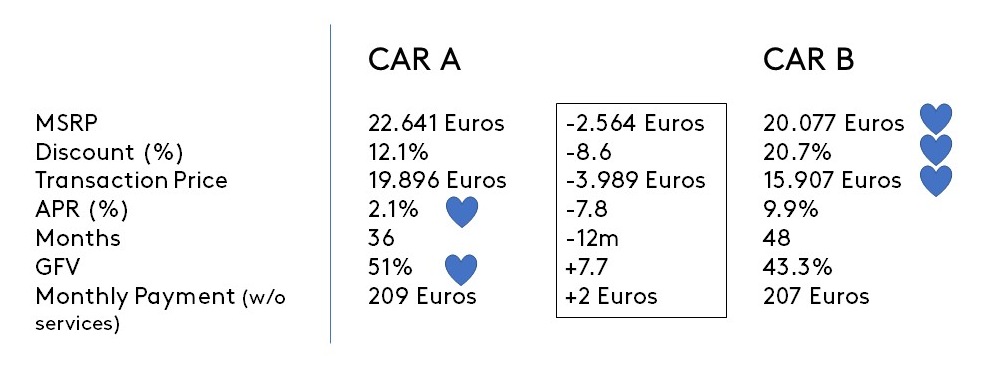

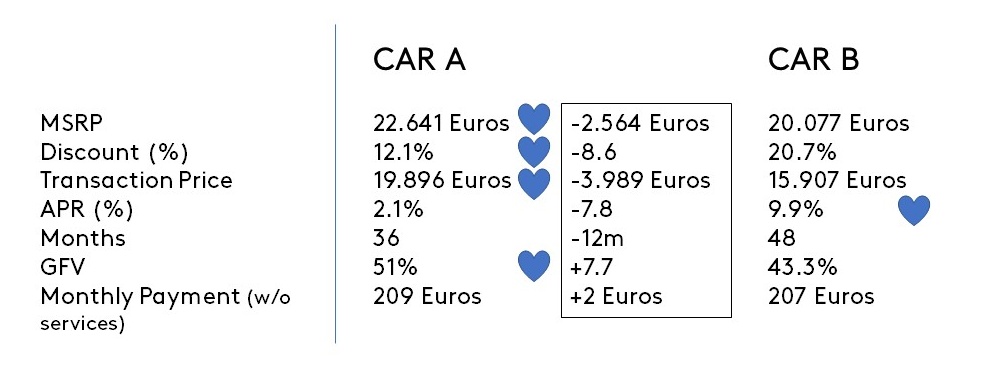

Let’s take the following illustration as an example: Which car would be more attractive to you as a customer?

A ‘traditional’ customer would consider Car B a much better deal as it has a lower transaction price, driven by a higher discount (20.7%)… right? But what if I am looking for finance or a lease; in this case, both cars would be attractive as their Monthly Payment fees are similar. Car A manages to compete with the other model thanks to a lower Annual Percentage Rate (APR%) and a higher Guaranteed Future Value (GFV).

This ‘new’ competitiveness scenario opens the door for customers to add new models to their shopping lists that may previously have been out of their scope. Therefore, it is fundamental that the automotive brands work together with the finance entities to set the correct balance between the competitiveness and the profitability of their model range portfolio. And now, if you were an automotive manufacturer: which model would you prefer in terms of profitability/revenue generation?

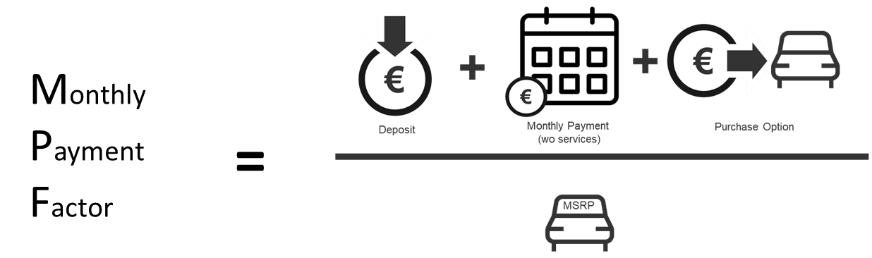

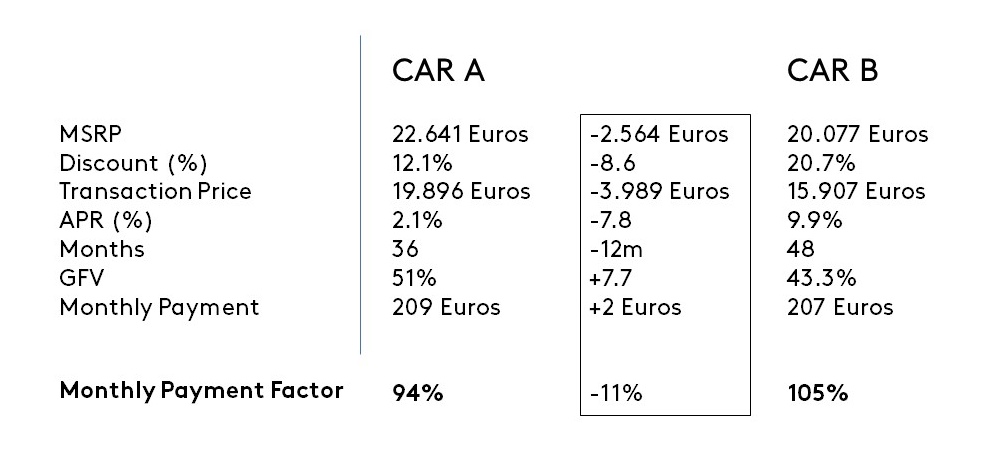

Car A seems to be a much better deal for the company as it has a lower discount (DSC%) and higher Transactional Price, but at the same time Car B has a higher APR... Against this complex and challenging landscape, we have worked with promoCAR to develop a new Indicator to evaluate the positioning of cars. The Monthly Payment Factor indicates the total income that a brand can expect from a client along the contract in % over the List Price:

Taking again our example, Car A with a lower DSC and a higher APR would “only” be able to recover 94% of its List Price (MSRP), whilst Car B, despite a higher discount and apparently lower profitability, is able to recover 105% of its MSRP at the end of the finance contract:

Automotive pricing experts across the industry should reconsider their current price positioning analysis methodologies and evaluate whether these account for new scenarios. This will ensure that they bring accurate and meaningful decisions to their pricing strategies, in both competitiveness and profitability.