Survey respondents have a digital life outside their online panel community; a life as a consumer, an influencer and a potential buyer. But technology is evolving, and so is digital usage. Consumers are leaving a bigger digital fingerprint that increases exponentially by the minute, if not by the second. It expands by source, by type and by size. It is creating an ocean sized pool of third party data, which we are still learning how to best utilize in our data collection and analysis.

In our Marketing Data Integration series, we first touched upon how to get the best data output from your survey questions, now we will look at integrating third party data. How can we access this data pool? How do we link survey data to it for a holistic, enriched view of our customers and non-customers? Let’s explore…

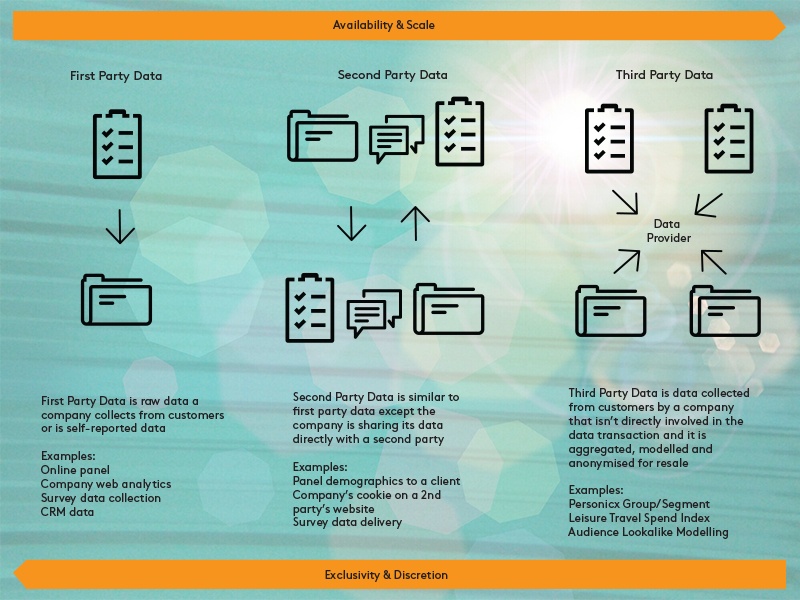

Hold on, what is third party data?

It is data considered independent, anonymized and several degrees away from the original data collection, which can be first or second party data. Third-party data can be inferred, modelled or clustered to provide insight on attitudes, behaviours and spending habits, without exposing individuals.

One example is a source of credit card transaction data that has been anonymized, aggregated and clustered to indicate how much someone is likely to spend, or what product someone is more likely to buy. This data is packaged as “credit card spend index” or “purchase category flags.” Because it is not tied to one individual’s spending behavior, the benefit is having an indication of consumer habits and shopping behaviours without invading privacy.

Another example is lifestyle consumer segmentation, such as Mosaic or Personicx groups, which cluster multiple third-party data points into common traits or profiles to make data more digestible.

When we connect these third party data sources to segments defined by survey data, a more holistic picture of consumers appears.

How can I link my survey data to third party data?

Now that we understand what third party data is and how it can enhance survey data, how do we collect and connect it? There are three ways you can match available data sources to survey data:

1. By Person

The first way to match an individual or their household to a third party data segment or index is via Personal Identifiable Information (PII). Name, address, postcode, mobile number, email address, are all data points that can be used to make the connection. This is called a deterministic match.

2. By Tagging

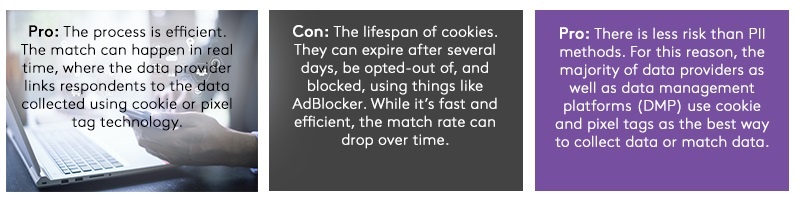

Second in line is cookie drops or pixel tags. This match is done on a device level, where a cookie is dropped on a computer, or a pixel tag is implemented in an app on a smartphone to track behaviour and build a profiling data set around who a consumer is. This is called a probabilistic match.

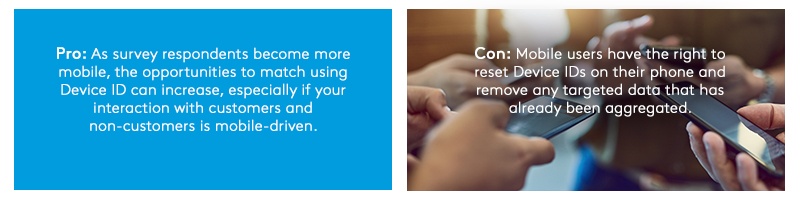

3. By Device

Last but not least, we have Device ID (or De-ID). This is a more recent form of match at a device level and driven by smartphone technology. Every Android and iPhone have a Device ID that is created as part of a Google Account or Apple ID. It was originally conceived for delivery of targeted digital advertising, but it has now become an essential driver in identifying profiles between data sources. It’s still a probabilistic match like cookies and pixel tags, but it reduces uncertainty.

Feeling Dis-connected?

Are any of these methods still unclear? What if you don’t hold PII? What if you don’t understand cookies and tags?

It is important to note that until recently, we treated connections to third party data as an exact match at individual level between survey respondents and data provider. However, the option for a fuzzy match is available if you find common attributes between the survey data and the data provider. The simplest example is matching Mosaic and Personicx segments. These are widely popular and are available across the digital domain. If you are able to identify your survey segments as belonging to a Personicx segment, you may be able to match your survey data to the same Personicx segment.

More forms of matching may become popular in years to come as technology evolves. Think of blockchain. Think of social media integration. Think of how DMPs today may change tomorrow. Third party data is complex and can be daunting, but it is out there within reach if you know your research objectives and understand there are data experts available to help connect your research to it.