With inflation high in many markets and at the tipping point of a recession in others, some countries still coping with the ravages of COVID-19 and others with the ramifications of war, it's not surprising that we see uncertainty in consumers and uncertainty among marketers.

At Kantar, we have access to many valuable sources of data, from our extensive normative data to up-to-date consumer insights from surveys. Recognising the many challenges our clients face as a result of the current financial environment, we turned to our multiple data sources to answer the most pressing questions.

From this analysis, we identified five imperatives for marketers in inflationary times to provide input to strategic planning in 2023.

1. Understand your consumers

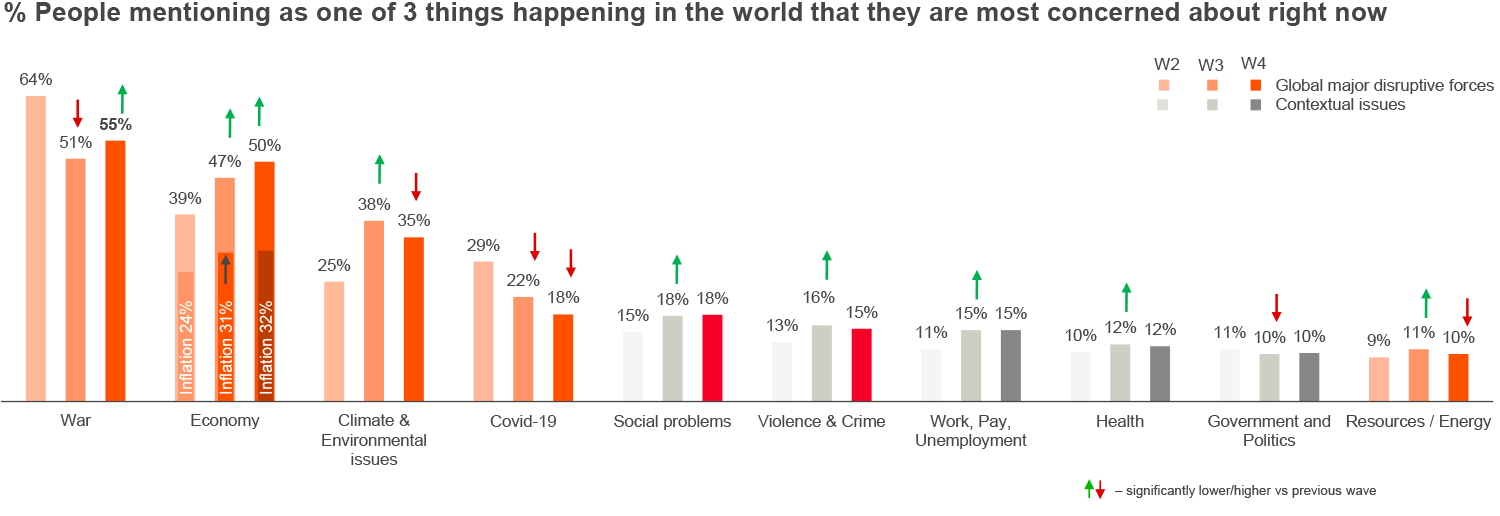

Throughout 2022 our Global Issue Barometer has kept a pulse on how people are thinking and feeling around the world. The survey asks over 11,000 people in 19 markets to say in their own words, what issues are on their minds. Our latest wave 4 data shows that the hierarchy of concerns remains unchanged: War is the biggest concern, followed by the economy, climate and environmental issues, inflation, then COVID-19.

The hierarchy of top concerns remains: war, economy, climate, inflation

With regard to the economy and inflation, many people (67%), view the economic outlook for their country as poor – and almost half (46%) feel negative about their own household’s financial situation. 48% can meet their monthly outgoings, but 45% say it is hard to do so and the rest say they can’t. So times are tough for many.

To cope with their financial struggles people are cutting back on general expenditure (27%), looking for promotions (26%), shopping in cheaper stores (22%), making shopping lists (22%) and setting and sticking to spending limits (20%). Luxuries, small and large, entertainment, holidays and eating out are all vulnerable to meet the need to save.

Generally, people aren’t panicking, but they are being careful, and all kinds of purchases are under scrutiny.

The next most pressing issue is climate and the environment. Kantar’s Planet Pulse shows that concerns rose by 50% after the summer, resetting at a higher level. This is the area where people most expect businesses to act, but currently 38% of people think they are making the climate crisis worse. Furthermore, the premium pricing of many sustainable products positions the sector as a luxury, and in today’s economic context, luxuries will be the first to go for many people.

People’s concerns and coping tactics do vary by country. Inflationary worries dominate in the UK (55%). China and the Philippines are worried about COVID-19. And violence and crime is a top three issue in the US, Nigeria and South Africa.

So the first implication for brands is to really understand their target audience and what is worrying them. Find ways of helping people and make sure your brand creates value and meets their needs.

2. Manage your price increases

Marketers need to take consumer views and habits into account. But they're also challenged to safeguard profits as costs rapidly rise. So how can you maintain pricing power when consumers are looking for price reductions?

To answer this question we looked to our Meaningfully Different framework (MDf). Three metrics, meaningful, difference and salience are combined to measure a brand's Pricing Power. Pricing Power measures a brand’s ability to justify a price premium relative to the category average. It reflects people's willingness to pay more for a product or service, and unwillingness to substitute it.

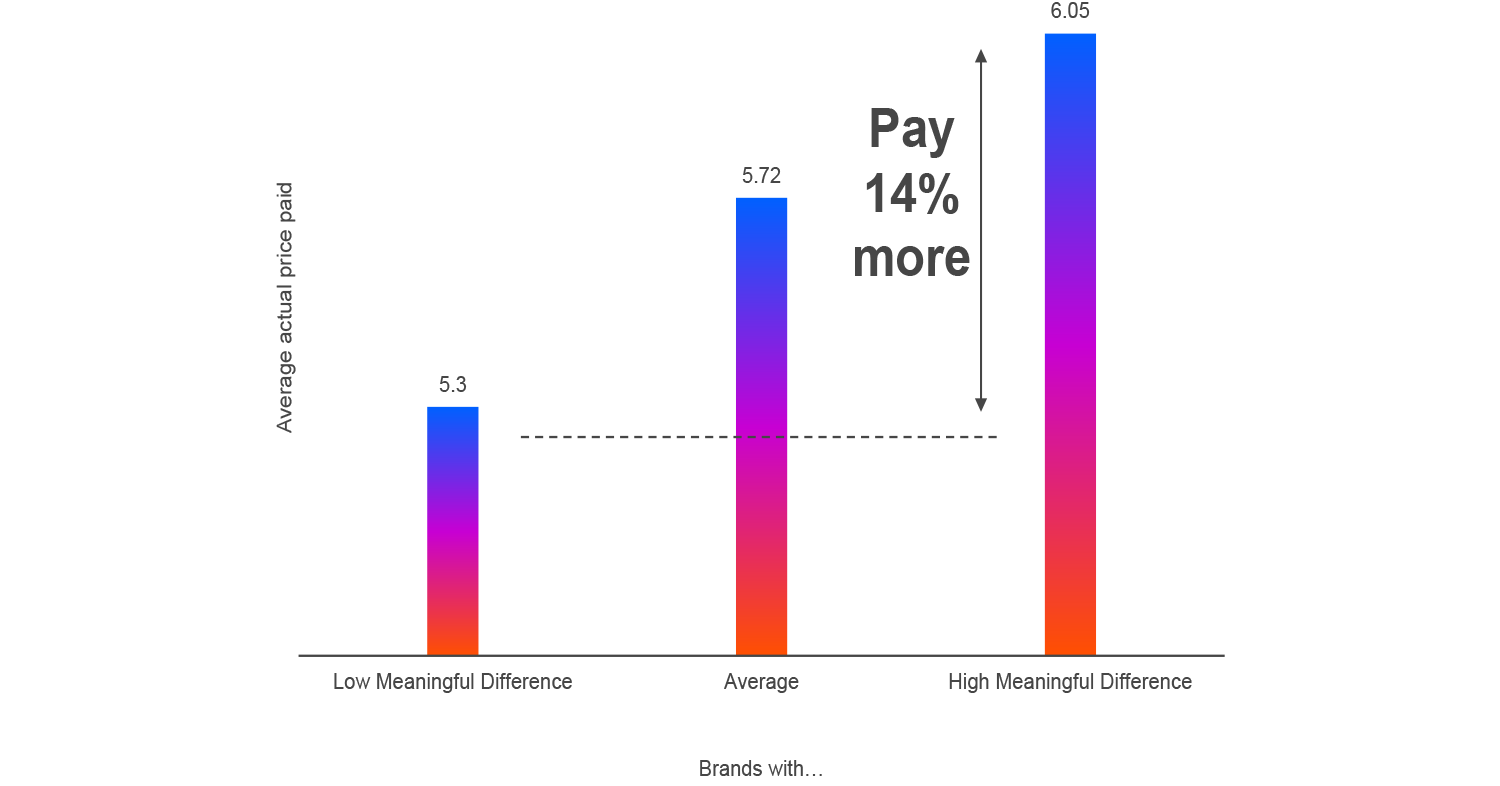

Our validations show a proven link to increased revenue, margins and profits for a brand. People are prepared to pay double for some products with high Pricing Power. We even found that people who can't resist a good bargain are willing to pay 14% more for the brands they consider to be meaningfully different.

Even people who can’t resist a bargain are willing to pay more

People are not necessarily looking to reduce costs in every aspect of their lifestyle, and as they prioritise, meaningful and different brands will come out on top.

So don’t go into sales promotions mode. Manage your price increases judiciously. Ensure your brand is meaningfully different and demonstrate the value of your brand.

3. Continue to invest in your brand

Kantar BrandZ data clearly shows that strong brands bounce back more quickly after a crisis than weaker brands. Compared to the S&P 500 and the MSCI World Index, strong brands are much more resilient when times get tough. We saw a faster recovery following the global financial crash of 2008, and more recently following the COVID-19 pandemic. This demonstrates the true value of marketing investment in difficult times.

Kantar BrandZ: Strong brands bounce back more quickly

Source: Kantar BrandZ, S&P Capital IQ, April 2006-Feb 2022 3

As achieving a differentiated brand position can lower customer price sensitivity, brands must continue communicating their uniqueness through their advertising.

And our recent Kantar Profiles Network poll shows that only 5% of people believe that companies should stop advertising during the current economic crisis. We also know from analysis of brand tracking data that going dark or significantly cutting ad spend has a serious long-term detrimental effect on brand equity – that takes a long time to recover from.

The Global Issues Barometer also shows that over half of people think it's a good idea for brands to communicate the positive actions they are taking through advertising. So, if you are taking concrete steps to help people – tell them but avoid generic sentimental claims like “We’re all in this together” – that doesn’t cut it.

Higher-priced brands will need to justify their premium, even more so than before. Communication that clearly delivers a meaningfully differentiating message will help defend the brand choice in the current environment.

Brands that commit the necessary marketing investment to establish deep consumer connections are better off in the long term. So, continue to invest in your brand and don’t stop advertising - but spend wisely. Strong communications accelerate brand growth, even in a crisis.

4. Test your ads

The key to successful communication in challenging times is getting the messaging right. Over half of people in our poll say that brands should offer a positive perspective. And half say brands should show how they can help people in their new everyday life. In other words, be helpful and supportive, and don’t exploit the current financial situation.

There is space for a little bit of levity and a little bit of joy even in the current situation, but understanding emotional responses is key to this. The content and the tone of your advertising matter at times like this, so make sure you test and get it right.

There is also increased pressure to ensure that every marketing dollar invested has an impact, so you don’t waste precious budget on ads with low ROI.

Strong creative can also magnify media spend. You can make up for media budget cuts with quality creative – so pre-test and make sure it’s the best it can be.

And ads perform differently in different environments – so test in context and understand the best synergies in your media mix to make your budget go further.

Don’t do anything too drastic with your communications and understand the impact of any short-term actions. Ensure your communications connect and resonate with your audience – and show some empathy.

5. Get emotional

People are experiencing many pressures, and most are coping, but they need a little light relief. Successful ads engage people’s emotions.

We use Affectiva’s emotion AI technology to understand how consumers’ emotional responses with facial coding. We capture facial expressions such as smile, brow furrow or raised eyebrows to understand how people are engaging emotionally with an ad. We analysed our facial coding database to see if people responded differently to ads during the pandemic and cost-of-living crisis. We found that people's emotional response to ads doesn't differ in times of crisis, and smiles didn't change dramatically during crises. So carry on doing what you’re doing – but be sensitive.

Be honest, be open and bring optimism. And don't rule out humour. Only 14% of people in our poll felt brands should avoid humorous tones. Humour is an important creative tool, but we’ve seen a decline in its use in advertising. Done sensitively in difficult times it can be uplifting.

Cadbury’s Secret Santa ad is a great example of humour done well. It is the highest-ranking festive ad in Kantar’s database since 2019, performing strongly on branding, brand difference, meaningfulness and long-term brand-building potential. People felt it best celebrated the joy of Christmas in 2022 and also deemed it to be the most appropriate given the cost-of-living crisis.

So, engage people’s emotions – positively. Avoid sadvertising, instead focus on being a reassuring or even positive force, that can brighten up people’s day.

Input for 2023 planning

We live in a dynamic environment, and everything changes all the time, so it is vital to have the right data at your fingertips. You need to know how people are feeling and behaving, how your media is performing and if your creative is giving the desired response for your brand.

Watch our on-demand webinar for more details on how people are likely to respond to marketing initiatives - Under Pressure: What marketers need to know now for strategic planning. And get in touch to discuss the findings in more detail or for information on the Global Issues Barometer local and global reports that are available for sale.